U.S.

Trump hush money trial: Opening statements set for Monday

The Anthology’? Fans investigate the personal lyrics.

Entertainment

Mere hours into The Tortured Poets Department release, Swifties swarmed social media to dissect and decode all 31 tracks on Taylor Swift’s …

Oklahoma gymnastics suffers stunning collapse in NCAA semifinals

Sports

FORT WORTH, Tex. — Oklahoma, the most dominant NCAA women’s gymnastics team this season and perhaps one of the best in the …

Jupiter’s violent moon Io has been the solar system’s most volcanic body for around 4.5 billion years

Science

The solar system’s most volcanic body, the moon of Jupiter Io, has been in turmoil for at least 4.57 billion years, right …

It’s cutting calories—not intermittent fasting—that drops weight, study suggests

Health

Intermittent fasting, aka time-restricted eating, can help people lose weight—but the reason why may not be complicated hypotheses about changes from fasting …

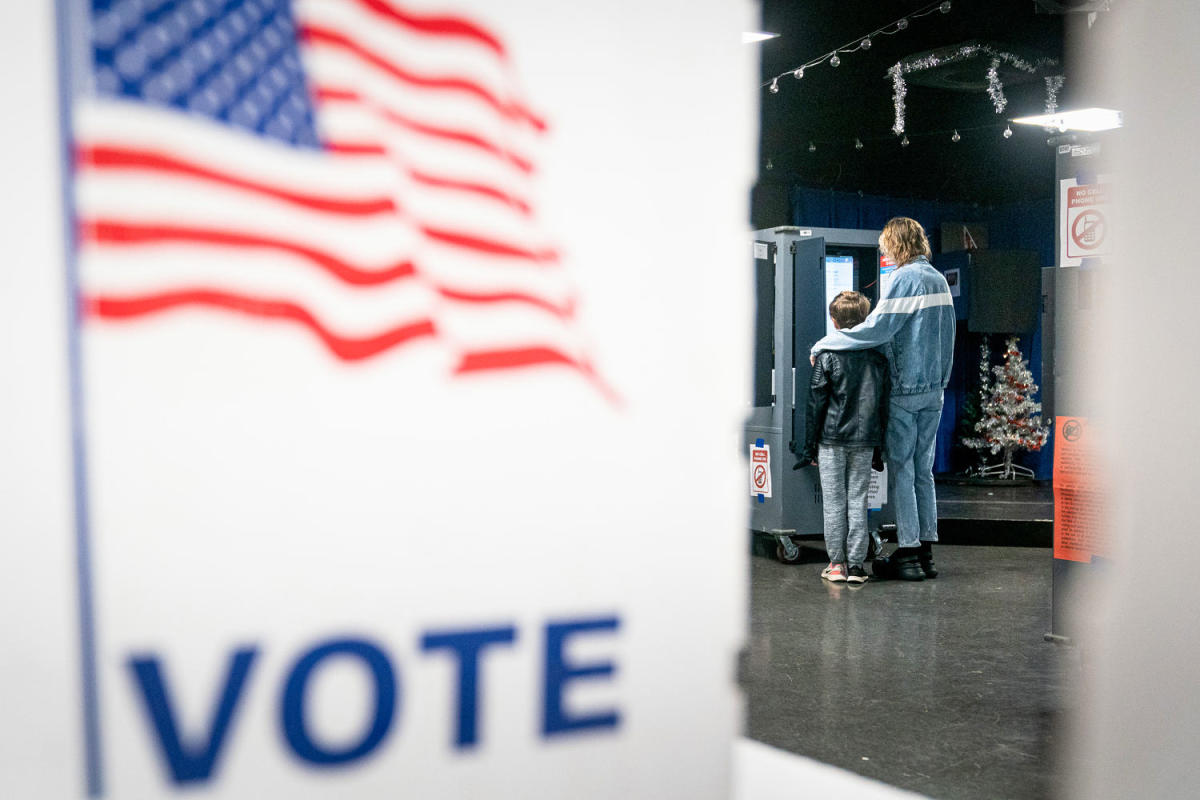

Trump’s frightening plan to ‘ensure a big win’

U.S.

Former President Donald Trump and the Republican Party announced a new program to supposedly “safeguard the integrity of the electoral process” by …

Trump’s criminal hush-money trial concludes jury selection after difficulties

Politics

Donald Trump’s hush-money trial gained momentum on Friday afternoon with the conclusion of jury selection. Five alternate jurors were chosen, following Thursday’s …

I’m a home product tester — and I did a double-take when I saw these chic patio chairs on sale for $37 each

LifeStyle

Real talk: I shop for deals on home items all day, and this might be the best one I’ve seen all week. …

Huge blast at military base used by Iraqi Popular Mobilization Forces

World

A huge blast rocked a military base used by Iraq’s Popular Mobilization Forces (PMF) to the south of Baghdad late on …