Business

JPMorgan warns stock market sell-off has ‘further to go’

Entertainment

Horoscope for Tuesday, April 23, 2024

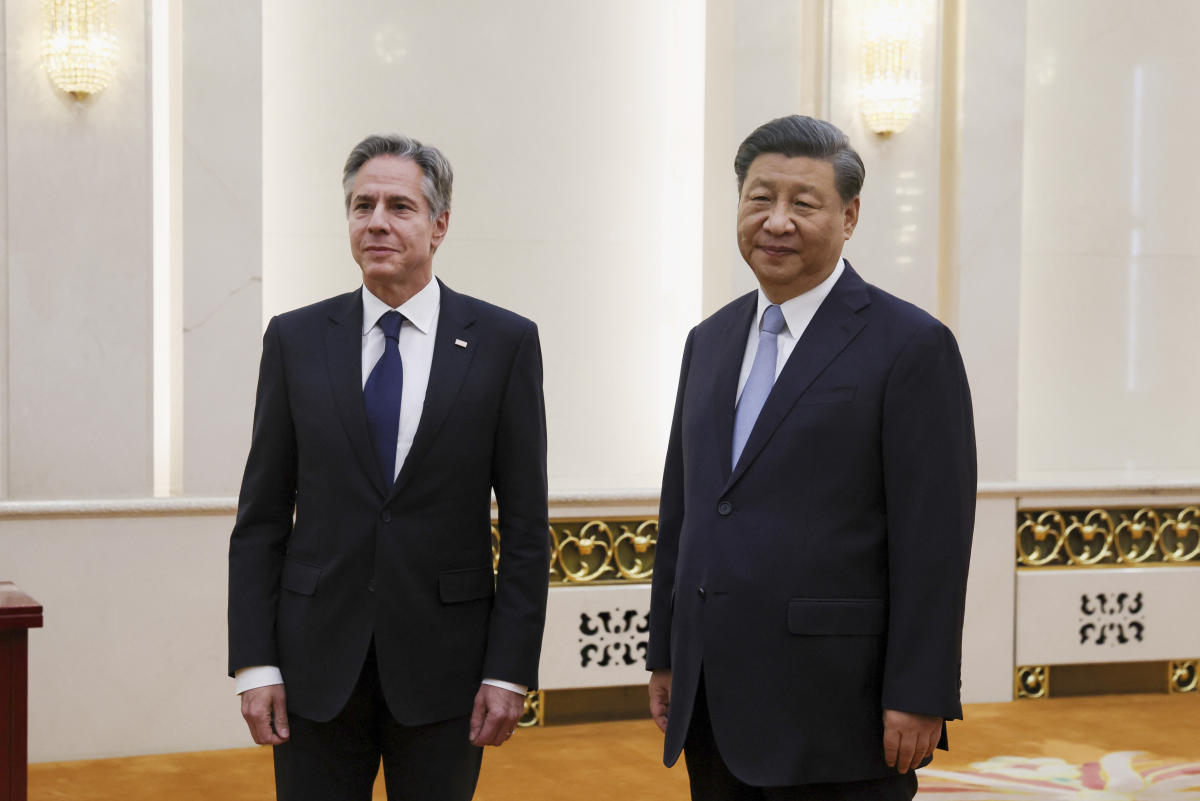

As Blinken heads to China, these are the major divides he will try to bridge

Politics

WASHINGTON (AP) — Secretary of State Antony Blinken is starting three days of talks with senior Chinese officials in Shanghai and Beijing …

Shop these Earth Day deals on eco-friendly electric bikes on sale for up to $1000 off

LifeStyle

It’s Earth Day 2024! Since 1970, April 22nd has been dedicated to reminding us to do our best to leave the planet …

Can Tales of Kenzara: Zau unlock a new world of video game stories?

Technology

By Andrew Rogers & Tom Richardson BBC Newsbeat 6 hours ago Image caption, Abubakar Salim grew up playing games – now he’s …

European Stocks Gain on Earnings, US Futures Flat: Markets Wrap

Business

(Bloomberg) — European stocks rose for a second day, tracking gains in Asian markets on optimism that big technology companies will deliver …

Celebrity handbag designer Nancy Gonzalez jailed for wildlife smuggling

Entertainment

5 hours ago Image source, Getty Images A Colombian luxury handbag designer who pleaded guilty to smuggling purses made of the skins …

Knicks steal Game 2 from 76ers with miraculous 8-0 closing flourish

Sports

The Philadelphia 76ers appeared headed home with a split at Madison Square Garden before the New York Knicks delivered a miraculous closing …

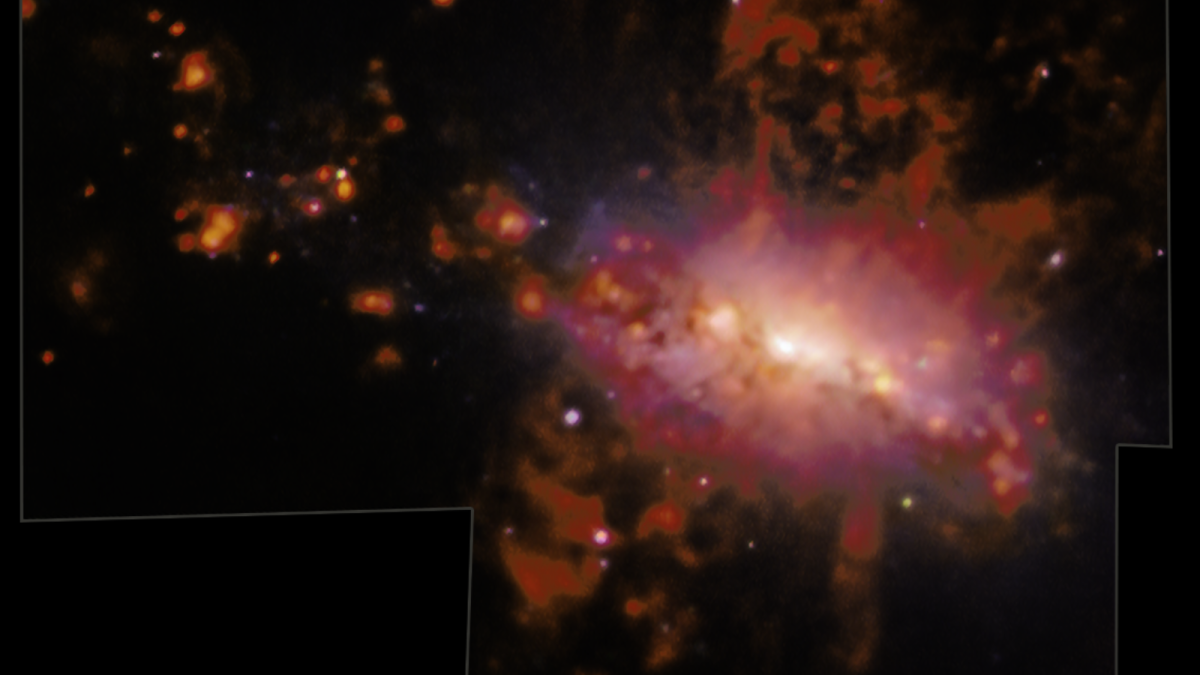

Cosmic fountain is polluting intergalactic space with 50 million suns’ worth of material

Science

Tremendous explosions in a galaxy close to the Milky Way are pouring material equivalent to around 50 million suns into its surroundings. …