U.S.

Poverty and foster care numbers rise, but so do reading and math rankings

Jill Duggar Dillard And Husband Share Word Their 4th Child Was Delivered Stillborn

Entertainment

Jill Duggar Dillard, known for her role as part of a controversial reality TV family, and her husband, Derick Dillard, are mourning …

Kerr recalls feeling bad for Brown after Dubs eliminated Kings in 2023

Sports

Kerr recalls feeling bad for Brown after Dubs eliminated Kings in 2023 originally appeared on NBC Sports Bay Area Tuesday’s looming NBA …

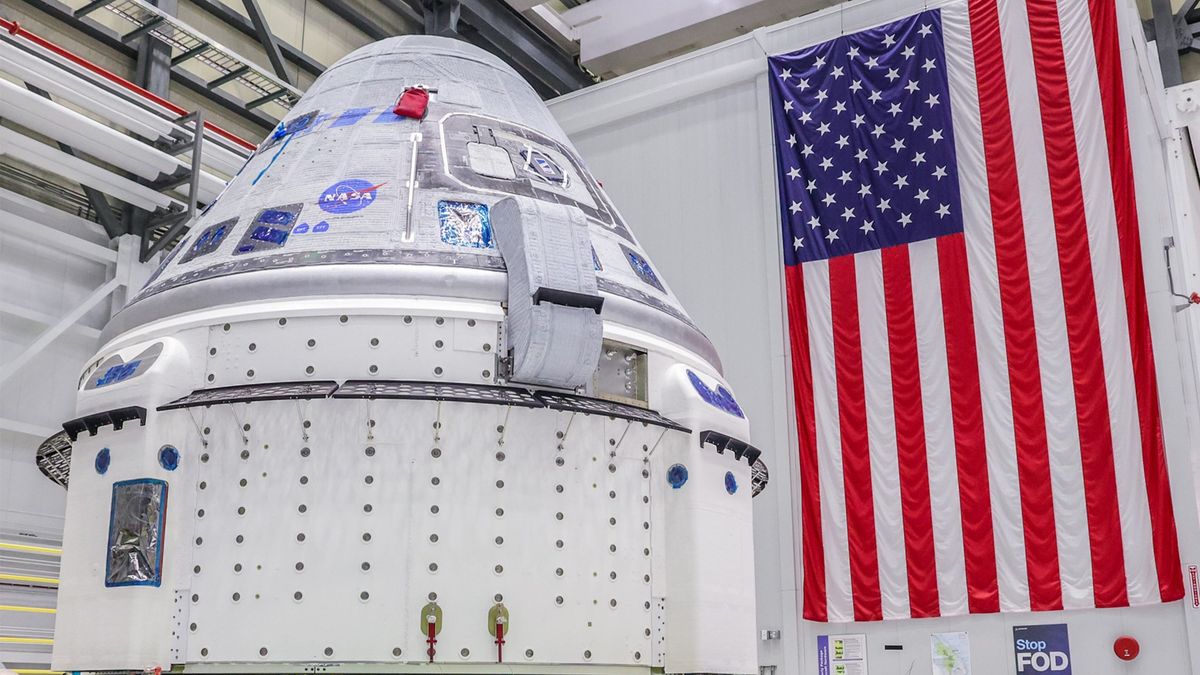

I flew Boeing’s Starliner spacecraft in 4 different simulators. Here’s what I learned (exclusive)

Science

HOUSTON — The commander of my spacecraft prepared for a steep spin next to the space station. “This is an alarming rotation …

Pollen counts in Rochester NY increasing, allergy season may be severe

Health

Allergies could be a ‘significant problem’ as warm winter may mean longer pollen season Rochester Democrat and Chronicle Spring allergies may start …

Trump back in court for hush money trial after no jurors picked on first day

U.S.

NEW YORK (AP) — Donald Trump will return to a New York courtroom Tuesday as a judge works to find a panel …

Why can’t Americans see or hear what is going on inside the courtroom?

Politics

NEW YORK (AP) — It’s a moment in history — the first U.S. president facing criminal charges in an American courtroom. Yet …

Apple’s massively popular AirPods are down to $89 at Amazon — that’s close to their Black Friday price

LifeStyle

It’s a personal-audio truism: Those who try AirPods love them at first listen and never look back. These durable wireless earbuds are …

Biden praises this country for backing Ukraine but uses name from over 30 years ago

World

Politics By Steven Nelson Published April 15, 2024, 6:38 p.m. ET WASHINGTON — President Biden on Monday praised “Czechoslovakia” for supporting Ukraine …