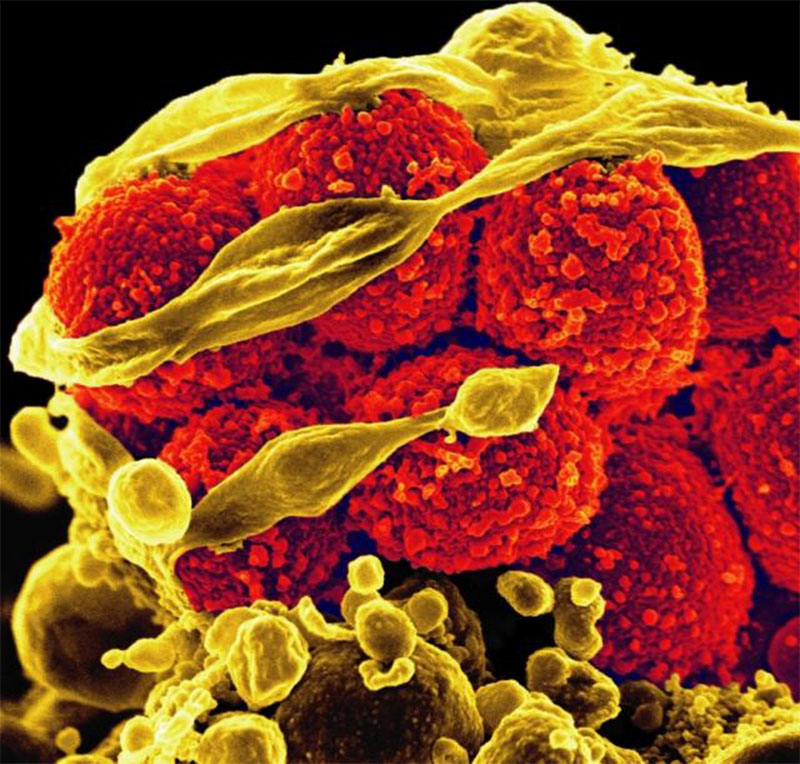

Health

Bird flu virus found in milk, is of “great concern” to WHO

Oil and gold prices rise as US says Israel has struck Iran

Business

Image caption, Iran is the seventh largest oil producer in the world Article information Author, Mariko Oi Role, Business reporter 19 April …

Robert Durst doc ‘kills it again

Entertainment

Need a new show to binge? These are the must-watch shows this spring From “Fallout” to “Bridgerton,” USA TODAY’s TV critic Kelly …

2024 Olympic Wrestling Trials Live Updates

Sports

The 2024 Olympic Wrestling Trials will take place on April 19-20 in State College, Pennsylvania. Check out the article below for real-time …

Extinct snake that measured 50 feet long discovered in India

Science

Researchers in India have discovered a giant extinct snake, measuring up to 50 feet long and believed to be the largest madtsoiid …

Maddow Blog | Three years later, Trump isn’t done targeting the Impeachment 10

U.S.

Many of Donald Trump’s endorsements are easy to overlook. The former president finds sycophantic allies and publishes cookie-cutter statements of support — …

How to buy Taylor Swift’s brand new album, ‘The Tortured Poets Department’

LifeStyle

It’s a huge week for Swifties. Not only did Taylor Swift unexpectedly show up at Coachella with her boyfriend, Travis Kelce, last …