LifeStyle

Amazon shoppers dub this the ‘most flattering T-shirt ever’ — get it for under $20

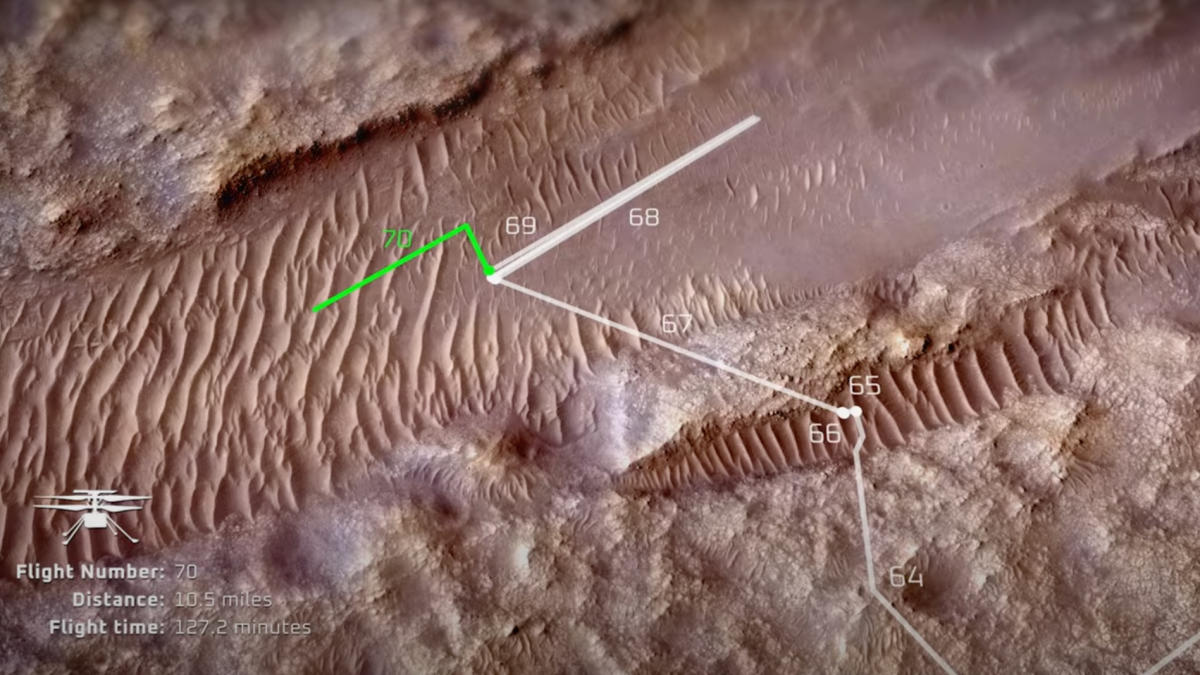

New NASA video tracks Mars helicopter’s 72 flights

Science

NASA’s history-making Ingenuity helicopter covered a lot of ground on Mars over the past three years, as a new video shows. The …

Could this diet actually help you live longer?

Health

Health By Amy Eisinger Published April 19, 2024, 4:07 p.m. ET For years, scientists have thought that eating less might help people …

Man dies after setting himself on fire outside courthouse where Trump is on trial

U.S.

Warning: This article contains an image some may find disturbing. A man who set himself on fire Friday outside the courthouse where …

Trump set to gain national delegates as the only choice for Wyoming Republicans

Politics

Republicans in Wyoming will decide Saturday which presidential candidate will get their state’s votes at the GOP national convention this summer — …

The Amoretu tunic dress is on sale at Amazon

LifeStyle

Can’t find the perfect flowy dress to add to your closet this season? Well, we have a suggestion: Flattering and forgiving, the …

Israel and Iran’s apparent strikes give new insights into both militaries

World

WASHINGTON (AP) — Israel demonstrated its military dominance over adversary Iran in its apparent precision strikes that hit near military and nuclear …

LittleBigPlanet 3 Servers Are Officially Shut Down ‘Indefinitely,’ Sony Confirms

Technology

Sony has confirmed that LittleBigPlanet 3 servers on PlayStation 4 will remain offline “indefinitely” following troubles with the service from earlier this …

S&P 500 falls for 6th day in a row amid weakness in mega-cap tech

Business

A trader works during the Fed rate announcement on the floor at the New York Stock Exchange (NYSE) in New York, U.S., …