LifeStyle

This No. 1 bestselling skort is comfy-cute on and off the pickleball court

Stocks making the biggest moves midday: UBER, INTC, LYFT, RIVN

Business

Check out the companies making headlines in midday trading. Uber Technologies — The ride-hailing giant fell more than 8% after posting mixed …

Inside Instagram ‘bully’ Katherine Asplundh’s extravagant wedding to billionaire husband

Entertainment

Cabot’s family cofounded a tree trimming company and is now worth $3 billion He and Katherine tied the knot in Palm Beach, Florida, on …

The NBA’s One-Man Band Era Is Here

Sports

Jalen Brunson is more than just the leading scorer in the 2024 NBA playoffs. He is the centerpiece of the best New …

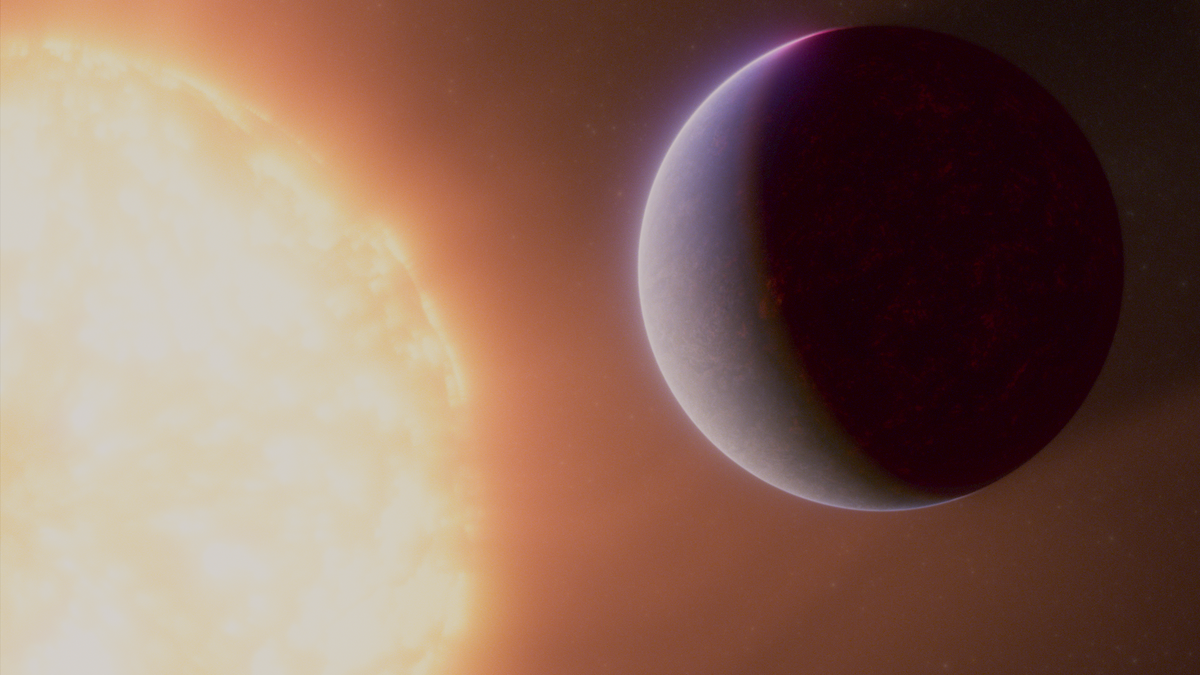

A Planet Just 41 Light-Years From Earth Has an Atmosphere and Is Covered in a Magma Ocean

Science

Scientists have spotted a rocky exoplanet with a possible atmosphere, which they believe may be burbling out from a magma ocean on …

Majority of Adults At Risk for CKM Syndrome

Health

TOPLINE: Nearly 90% of adults were at risk of developing cardiovascular-kidney-metabolic (CKM) syndrome between 2011 and 2020, according to new research published …

Jonathan Yudelman, ASU scholar, on leave after protest confrontation

U.S.

An Arizona State University scholar is on leave after a video of him screaming profanities into the face of a woman wearing …

This bestselling tennis bracelet arrives in time for Mother’s Day

LifeStyle

Let the moms at Yahoo let you in on a tip: Jewelry is always a sure-fire bet for a Mother’s Day gift. …

AstraZeneca withdraws Covid-19 vaccine citing low demand

World

Antonio Masiello/Getty Images A healthcare worker prepares doses of the AstraZeneca Covid-19 vaccine at a vaccine hub in the Auditorium della Tecnica …

/cdn.vox-cdn.com/uploads/chorus_asset/file/25437166/Apple_iPad_Air_2024_Lifestyle_Image.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/73334884/GoldsberryNBAHeliocentricStars_AP_Ringer.0.jpg)