Sports

NFL Draft Round 1 Recap: 5 biggest fantasy storylines & instant draft grades

Garry’s Mod Is Removing “All Nintendo Related Stuff From Steam Workshop”

Technology

Image: via Steam Update [Fri 26th Apr, 2024 01:30 BST] After further investigation, Garry’s Mod creator and Facepunch Studios founder Garry Newman …

Google protesters fired. What’s fueling crackdown on Gaza activists.

Business

World Central Kitchen workers killed in Gaza remembered in DC Seven World Central Kitchen workers who were killed in an Israeli drone …

Horoscope for Friday, April 26, 2024

Entertainment

Moon Alert There are no restrictions to shopping or important decisions. The moon is in Sagittarius. Aries (March 21-April 19) Oh, happy …

India begins second phase of national elections with Modi’s BJP as front-runner

Politics

NEW DELHI (AP) — Millions of Indians began voting Friday in the second round of multi-phase national elections as Prime Minister Narendra …

Chiefs trade up, pick speedy WR Xavier Worthy in NFL draft

Sports

Adam Teicher, ESPN Staff WriterApr 26, 2024, 01:23 AM ET Close Covered Chiefs for 20 seasons for Kansas City Star Joined ESPN …

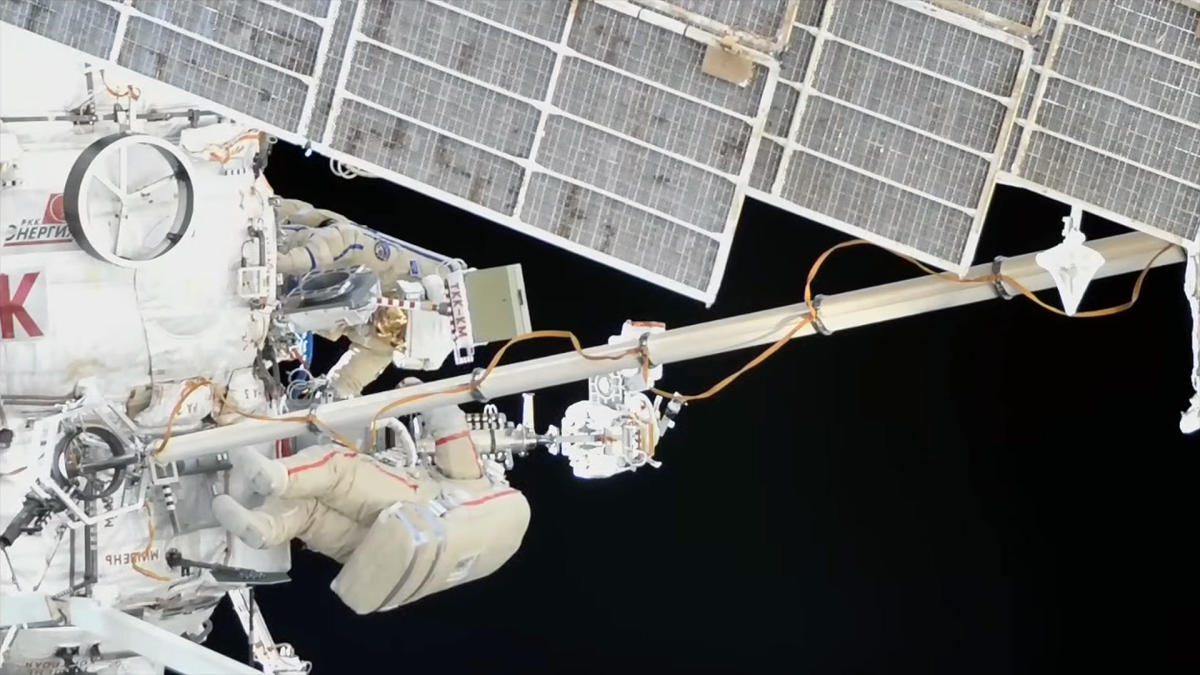

Russian cosmonauts make quick work of space station spacewalk

Science

Two Russian cosmonauts completed a spacewalk at the International Space Station, wrapping up all of their tasks with time to spare, including …

Midwest region gas prices fell from last week: See how much here

U.S.

Regional gas prices fell last week at an average of $3.46 per gallon of regular fuel on Monday, down from last week’s …