When it comes to the manufacturing of advanced semiconductors used in artificial intelligence (AI) systems, there is a little-known segment of the industry that acts as the gatekeeper: metrology equipment.

Chief among metrology equipment providers is KLA Corp., whose stock is sporting an incredible nearly 75% gain in the last one-year stretch. But a smaller peer, Onto Innovation (NYSE: ONTO), is up nearly 105%. Why? And is it still a buy?

A key to making more advanced chips

Metrology (the science of measurements) and process diagnostics and control (PDC, basically quality control on a manufacturing process) is a critical stage after a chip is designed. Early in the chipmaking process, metrology and PDC equipment ensure the new chip functions correctly and is free of defects that impact performance. Companies like Taiwan Semiconductor Manufacturing and Intel rely heavily on metrology and PDC equipment when developing new and more advanced manufacturing processes.

Thus, think of metrology equipment as a type of final step in building AI systems, a type of gatekeeper to unlocking more powerful computing.

While KLA Corp. has received attention over the years as a fantastic dividend growth investment, Onto Innovation is a little-known competitor. It’s the product of a 2019 merger between two small metrology companies, a move that helped the business scale up its operations to attain greater efficiency (higher profit), which in turn has helped it invest in and unveil new metrology technologies for its customers.

It’s been an incredible run for Onto, and the small business isn’t finished. It keeps rolling out new equipment and metrology features to address all steps in the complex chipmaking process, from advanced wafer inspection all the way to the final dicing of those wafers into chips and packaging them into a computing system. Some of Onto’s recent equipment announcements are far-reaching, addressing its chip manufacturer customers’ product roadmap years from now.

Can the Onto party continue?

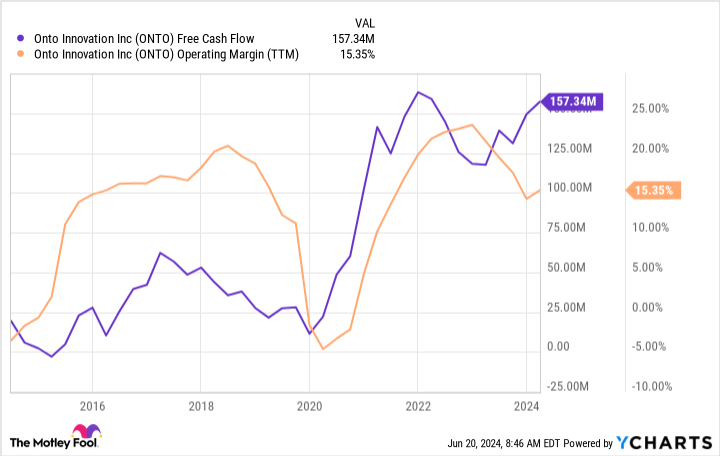

After the recent run-up, Onto stock trades for an “expensive” 82 times trailing-12-month earnings per share (EPS) according to generally accepted accounting principles (GAAP), and 72 times trailing-12-month free cash flow (FCF). However, bear in mind that like all manufacturing-based businesses, Onto is cyclical. The EPS and FCF figures from the last year include the effects of the bear market that had dramatically brought Onto’s profitability down in 2023.

To illustrate how the rebound in profits (and thus the valuation) can change just as dramatically to the upside, Onto reported a 4.6% quarter-over-quarter sequential increase in revenue in Q1 2024 versus Q4 2023, but an 11% sequential increase in adjusted EPS.

Management is forecasting another step-up in revenue and profitability in Q2, with the high end of revenue guidance of $240 million implying another 4.8% rise from Q1 — and a 7% sequential increase, and 59% year-over-year increase, in adjusted EPS. Suffice to say the valuation may not be as expensive as it appears on the surface.

Additionally, there are dozens of new chip fab (a facility that makes semiconductors) construction projects underway around the globe, and dozens more of existing fab updates. Industry organization SEMI.org predicts advanced wafer fab equipment, like what Onto provides for AI chipmakers, will reach record levels in 2025 and continue hitting new highs through 2027, growing at a low- to mid-teens percentage. The market is expected to begin heating up in the second half of this year. Onto’s sales are poised to follow a similar trajectory.

I don’t expect Onto Innovation’s stock to perform in the same exceptional fashion as it has over the last 12-month period. However, there could be plenty of upside left in this smaller metrology equipment and under-the-radar AI stock. I’m more than happy to continue holding my position.

Should you invest $1,000 in Onto Innovation right now?

Before you buy stock in Onto Innovation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Onto Innovation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Nicholas Rossolillo and his clients have positions in KLA and Onto Innovation. The Motley Fool has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

1 AI Chip Stock That’s More Than Doubled in a Year — Is It Still Time to Buy? was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.