In today’s market, cybersecurity stocks have become increasingly notable growth stocks. Such security is crucial to maintaining the integrity of cloud computing, and companies have become innovators and users of artificial intelligence (AI) as that technology has become a critical source for both threat prevention and security.

One of the better-performing companies in this space is Zscaler (NASDAQ: ZS), the leading company in zero-trust security. However, even after releasing a strong earnings report, it failed to recover its losses from the 2022 bear market, and it sells for a 55% discount to its November 2021 high.

Despite such setbacks, Zscaler could be setting the stage for a long-awaited recovery to take shape. Here’s why investors should add this stock to their watch lists, and maybe their portfolios as well.

Why Zscaler?

As previously mentioned, Zscaler leads its industry in zero-trust security because it pioneered the technology. In a cloud-oriented IT environment, firewall-based security was not adequate to protect mobile devices and servers that could be anywhere.

To this end, Zscaler’s zero-trust solution assumes that anyone attempting access to a network is a threat. Users gain access through contextual factors such as one’s device or location, the policies of a given business, and the user’s identity. Also, part of identity is rank, meaning some users may gain a greater degree of access than others based on one’s position in an organization. This limits the potential for harm should a hacker gain access to a network.

In addition to zero trust, Zscaler offers numerous products in other areas, including cloud firewalls, endpoint security, operational technology (OT) security, and other products. This strongly positions Zscaler to attract clients who prefer buying all cybersecurity products from one vendor.

Zscaler’s financials

The company’s rapid growth seems to show the growing popularity of Zscaler’s security products. In the first nine months of fiscal 2024 (ended April 30), the company reported almost $1.6 billion in revenue, a 36% increase versus the same period one year ago.

This includes a net dollar retention rate of 116%. CEO Jay Chaudry said on the fiscal Q3 2024 earnings call that faster upsells, bigger bundles, and customers buying more products at the start could reduce this retention rate. Still, the 31% increase in customers with over $1 million in average recurring revenue speaks to a high level of confidence in its security suite.

Moreover, the revenue increase exceeded the growth rates of the cost of goods sold at 33% and operating expenses, which rose by 21%. That reduced the losses for the first three quarters of fiscal 2024 to $43 million versus $172 million in the previous fiscal year. Additionally, Zscaler reported a net income in the fiscal third quarter of $19 million.

That quarterly profit makes it more likely the long streak of annual losses may finally end after this fiscal year. Also, if it meets its fiscal 2024 revenue forecast of just over $2.1 billion, revenue will grow at 32% for the year, a slight decrease from past quarters but still robust.

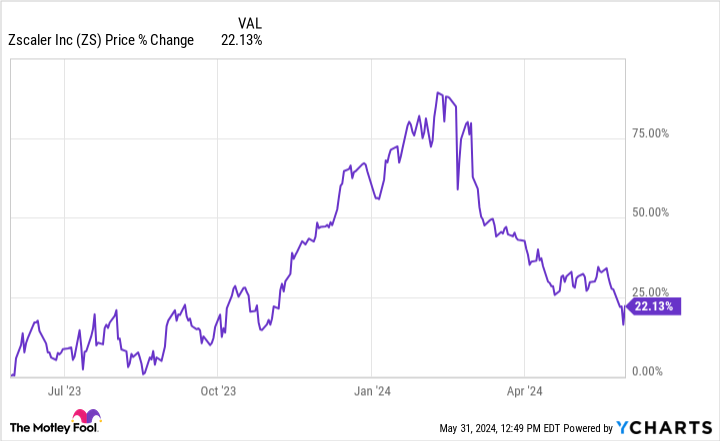

Despite that strength, the stock’s performance has offered a more mixed picture recently. Although it is up just over 20% over the last 12 months, it has declined by over 25% during 2024. A solid but slightly disappointing Q2 report appeared to sap investor confidence and dash hopes of reaching the $376 per share all-time high in the near term.

Nonetheless, the lower stock price gave it a price-to-sales (P/S) ratio of 13. That places the sales valuation near multiyear lows and well under the 20 P/S ratio at the beginning of the year. Considering Zscaler’s rapid revenue growth and the recent quarterly profit, investors could become comfortable with this valuation, indicating it could move much higher in the near term.

Consider Zscaler stock

Given the stock’s rapid growth and current state, investors should consider buying Zscaler at a 55% discount.

Admittedly, the stock is still not cheap, and its larger initial sales may slow net dollar retention increases. Also, its 2024 stock performance has probably frustrated investors hoping for a return to its all-time high.

Still, revenue continues to grow rapidly, and clients seem to have stayed with Zscaler. As more customers seek to deal increasingly with only one cybersecurity company, it should remain a leading stock in the online security space.

Should you invest $1,000 in Zscaler right now?

Before you buy stock in Zscaler, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zscaler wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Will Healy has positions in Zscaler. The Motley Fool has positions in and recommends Zscaler. The Motley Fool has a disclosure policy.

1 Growth Stock Down 55% to Buy Right Now was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.