Stock splits are back in the spotlight after Nvidia took this step recently. Investors should remember that this is simply a cosmetic move that doesn’t change the value and fundamentals of a company. What a stock split does is increase the number of outstanding shares while reducing the price of each share. So, the overall market value of the company remains the same.

However, there is a belief that a stock split might increase demand for a company’s shares because more investors would be able to buy them, with each share now available at a lower price.

That’s probably one reason why the likes of Super Micro Computer (NASDAQ: SMCI) and ASML Holding (NASDAQ: ASML) could consider splitting their shares. Let’s check why these two companies, which are playing a crucial role in the artificial intelligence (AI) revolution, look ripe for a stock split.

1. Super Micro Computer

The stock of Super Micro Computer (also known as Supermicro) has tripled in value over the past year and is now worth just over $760 a share. However, it’s still down 34% from the 52-week high that it hit in March, which is why management might consider splitting the stock to attract investor interest.

Supermicro has never executed a stock split. Management probably didn’t feel the need to do so because shares were trading at around $80 at the end of 2022. However, the booming demand for its AI server solutions has led to an 858% increase in its share price since the beginning of 2023. That means Supermicro has jumped by a multiple of more than 9 in less than 18 months.

That’s why the time looks ripe for a stock split at Supermicro. However, because a split is nothing more than a cosmetic move, now would be a good time to buy its shares regardless of a split to take advantage of the recent pullback in the stock’s price.

After all, the demand for Supermicro’s AI servers is so strong that its revenue tripled in the third quarter of its fiscal 2024 (which ended on March 31) to $3.85 billion, and adjusted net income quadrupled year over year to $6.65 per share.

Management has guided for fiscal fourth-quarter revenue of $5.3 billion and expects adjusted earnings to land at $8.02 per share at the midpoint of its guidance range. The company reported $2.18 billion in revenue in the same quarter last year along with adjusted earnings of $3.51 per share. If it meets its forecast, the top and bottom lines are set to more than double once again in the current quarter.

And Supermicro can sustain its healthy growth in the long run since the AI server market that it supplies is forecast to grow 26% annually for the next five years. AI server sales are predicted to increase from just over $12 billion in 2023 to more than $50 billion in 2029.

There are some more-ambitious estimates as well, with contract electronics manufacturer Foxconn expecting AI server sales to hit $150 billion in 2027.

Supermicro’s recent results indicate that it is growing faster than the AI server market, a sign that it is gaining ground in this space. In all, the company’s lucrative AI-related opportunity and its rapid growth are solid reasons to buy the stock now. What’s more, Supermicro is trading at just 21 times forward earnings, a discount to the Nasdaq-100‘s forward earnings multiple of 28 (using the index as a proxy for tech stocks).

So, investors have a nice opportunity to buy this AI stock, and they should consider taking advantage, considering its healthy prospects are not going to be affected by a stock split.

2. ASML Holding

ASML Holding is another company that could consider splitting its stock, with each share now trading at just over $1,040. The last time the Dutch supplier of semiconductor-manufacturing equipment executed a split was in October 2007, and its shares have surged 2,250% since then.

These impressive gains are a result of the central role that it plays in the semiconductor industry, and not because of its split almost 17 years ago.

ASML’s extreme ultraviolet (EUV) lithography machines allow foundries to make chips for a variety of applications. And AI is a catalyst that has customers lining up to buy its EUV machines to manufacture advanced chips using process nodes of 7 nanometers (nm), 5nm, 3nm, or smaller. The smaller the process node, the more powerful and efficient the chip is.

As the need for AI chips grows, ASML is witnessing robust demand for its EUV machines, and the company was sitting on an order backlog worth 38 billion euros ($40.9 billion) at the end of the first quarter of 2024. That’s higher than the company’s 2024 annual revenue forecast of $29.6 billion, which is in line with its revenue in 2023.

Management forecasts an acceleration in revenue growth in the second half of 2024 thanks to the recovery in the semiconductor market. Moreover, the company is set to start delivering its new machine, priced at $380 million, to semiconductor suppliers this year to help them manufacture advanced AI chips.

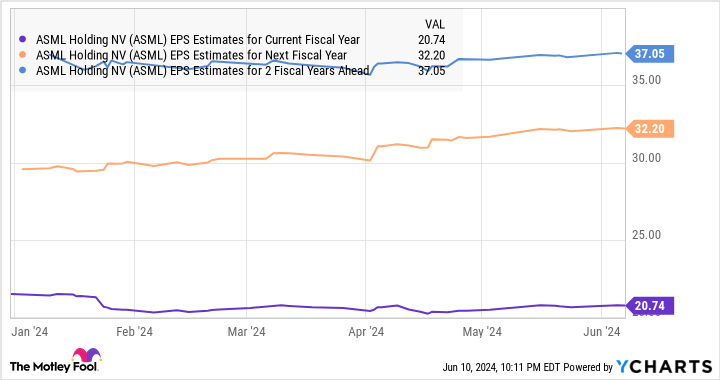

The market for those chips is forecast to clock annual growth of 38% through 2032, so ASML should continue to witness healthy demand for its EUV machines. And because it is the only manufacturer of these machines, it’s no surprise to see its earnings growth being predicted to accelerate significantly next year.

So even if the company doesn’t split its stock to lower the value of each share, its prospects suggest that it is built for more upside in the long run. Investors looking for a semiconductor stock with a mission-critical role in the AI revolution can consider buying ASML Holding before its growth accelerates.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.

Stock-Split Watch: 2 Artificial Intelligence (AI) Stocks That Look Ready to Split was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.