While tech-related stocks have helped the S&P 500 index to new highs this year, investors have a chance to scoop up attractive deals in the retail sector. Several top retail stocks are trading well off their highs, and Wall Street analysts are starting to see buying opportunities.

Let’s look at two beaten-down consumer brands that could be undervalued and due for a major comeback, according to these analysts.

1. Chewy

Chewy (NYSE: CHWY) is building a leading online pet care brand in an industry that is estimated at $147 billion, according to Statista. While the company is wrestling with weak consumer spending trends this year, the stock has rocketed 32% over the last three months and could be headed higher, according to Goldman Sachs analyst Eric Sheridan.

Sheridan recently maintained a buy rating on the shares. At the firm’s recent investor conference, Chewy CEO Sumit Singh made positive comments about active customer trends and long-term sales potential. Management believes its recent 3% year-over-year sales increase is below what it can achieve over the long term, which certainly seems doable given the size of the pet care market. Chewy expects to grow its customer base in the low-single-digit range and drive additional sales growth through increases in net sales per customer.

Chewy stock looks undervalued at a low price-to-sales ratio of 1.1 — well below the S&P 500 average P/S ratio of 2.9. The company still has great potential to gain share in the pet care market and expand profit margins from services like pet healthcare and sponsored advertising, which is not reflected by the low P/S multiple.

The stock’s low valuation could support near-term upside if investors decide Chewy is worth a higher P/S multiple, and that seems to be happening, with the stock moving higher over the last few months. There could be much bigger gains over the next few years if sales continue to improve.

2. Starbucks

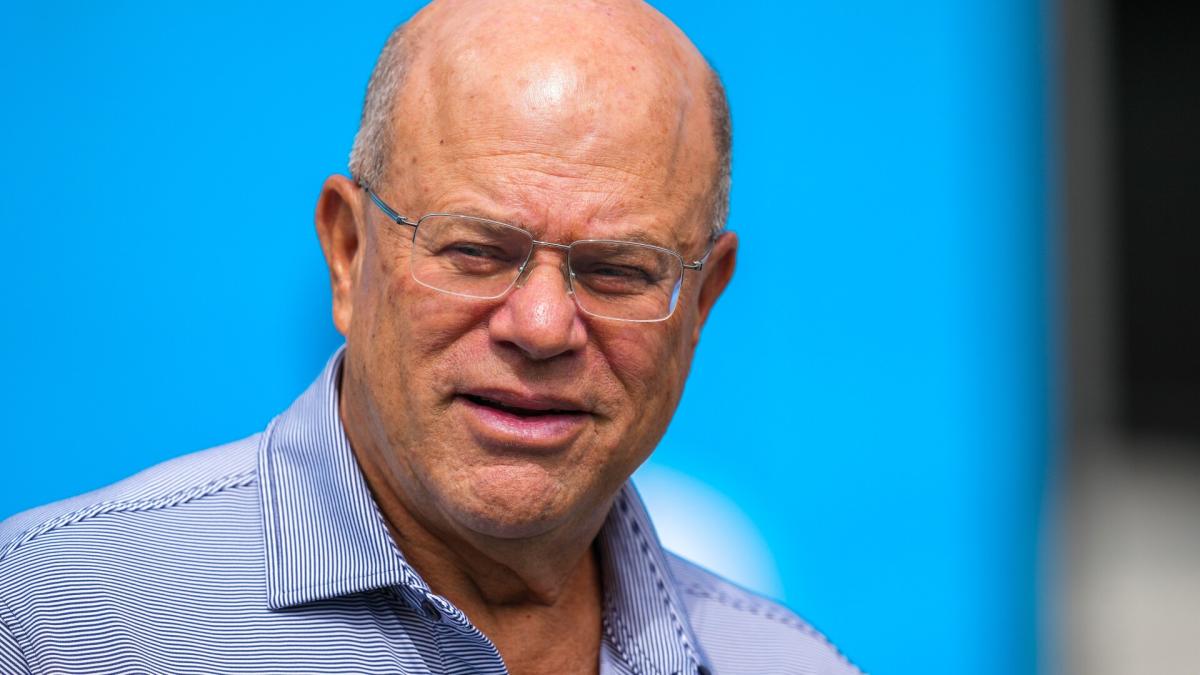

Starbucks (NASDAQ: SBUX) shares took a hit over slumping sales momentum and increasing competition, but the leading coffee brand is not sitting still. It made a bold move in hiring away CEO Brian Niccol from Chipotle Mexican Grill. The stock jumped sharply on the news, reflecting investor expectations that Niccol’s record of driving profitable growth at Chipotle — and at Taco Bell previously — will carry over to Starbucks.

BMO Capital analyst Andrew Strelzik recently maintained a buy rating on the shares following a recent update from Niccol on the turnaround plans. Niccol sees several areas where Starbucks can do better, including store consistency, improving the in-store experience, and improving the menu.

While the analyst still sees headwinds to the company’s near-term earnings performance, Niccol’s hiring could be a game changer for the business over the long term. Starbucks previously aimed to reach 55,000 stores by 2030, up from the recent quarter’s count of more than 39,400 company-operated and licensed store footprint. Niccol should maximize Starbucks’ revenue growth potential while also finding ways to grow earnings faster than revenue through higher margins, as he did at Chipotle.

The stock trades at a market average price-to-earnings ratio of 27, but Starbucks’ premium brand in the hands of an all-star CEO could lead to improved earnings growth that drives excellent returns in the coming years.

Should you invest $1,000 in Chewy right now?

Before you buy stock in Chewy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chewy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chewy, Chipotle Mexican Grill, Goldman Sachs Group, and Starbucks. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

2 Comeback Stocks to Buy on the Dip, According to Wall Street was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.