(Bloomberg) — European stocks were mixed as traders weighed concerns over China’s debt burden against dovish comments by a European central banker.

Most Read from Bloomberg

The Stoxx 600 was little changed, while US equity futures extended losses. German government debt advanced and money markets amped up easing bets after the ECB’s Isabel Schnabel told Reuters that further interest rate hikes are unlikely.

At the same time, emerging-market equities fell more than 1% after Moody’s Investors Service cut its sovereign debt outlook for China to negative. Haven assets like the US dollar and gold traded in the green.

November’s epic rallies in global equities and bonds have failed to continue into this month, suggesting some investors are concerned the market’s rate-cut wagers have been too aggressive.

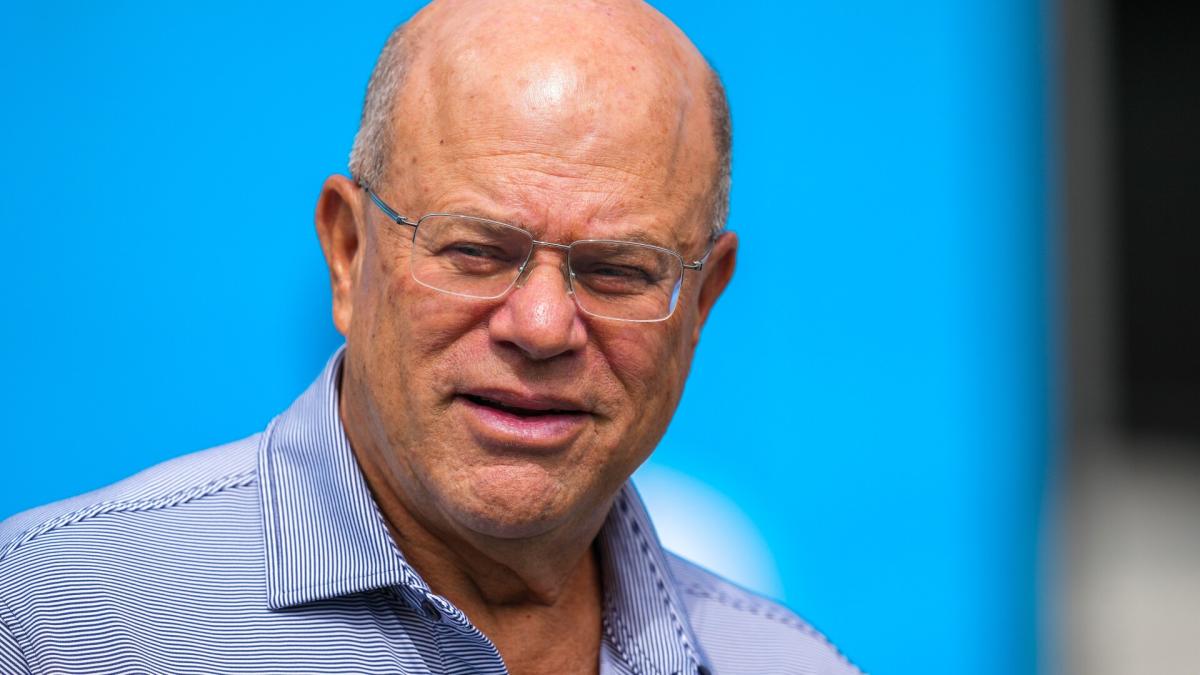

“I think people are going to get a lump of coal around Christmas” in terms of anticipation around “big rate cuts,” Cole Smead, portfolio manager at Smead Capital Management told Bloomberg TV. “I think the risk to stocks is economic growth,” he said.

US jobs data later in the week are expected to help gauge prospects for a soft landing.

Oil steadied after a three-day loss as Saudi Arabia said recent cuts by OPEC+ would be honored in full and could be extended.

Read: Treasury Strategists Debate Timing of Fed Cuts: Research Roundup

Read: Most Expect Their Investments to Do Better in 2024: MLIV Pulse

Key events this week:

-

Eurozone S&P Global Services PMI, PPI, Tuesday

-

US ISM Services, Job openings, Tuesday

-

Eurozone retail sales, Wednesday

-

Germany factory orders, Wednesday

-

US ADP private payrolls, trade balance, Wednesday

-

CEOs of the biggest banks on Wall Street, including JPMorgan, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America, expected to testify on regulatory oversight to the Senate banking committee, Wednesday

-

Bank of Canada monetary policy meeting, Wednesday

-

Bank of England issues biannual stability report on UK financial system, holds news conference, Wednesday

-

China trade, forex reserves, Thursday

-

Eurozone GDP, Thursday

-

Germany industrial production, Thursday

-

US wholesale inventories, initial jobless claims, Thursday

-

Germany CPI, Friday

-

Japan household spending, GDP, Friday

-

Reserve Bank of Australia’s head of financial stability Andrea Brischetto speaks at Sydney Banking and Financial Stability conference, Friday

-

US jobs report, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:31 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.4%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The MSCI Asia Pacific Index fell 1%

-

The MSCI Emerging Markets Index fell 0.9%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.2% to $1.0818

-

The Japanese yen rose 0.3% to 146.82 per dollar

-

The offshore yuan was little changed at 7.1529 per dollar

-

The British pound fell 0.1% to $1.2619

Cryptocurrencies

-

Bitcoin fell 1.3% to $41,502.25

-

Ether fell 1.8% to $2,195

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.23%

-

Germany’s 10-year yield declined seven basis points to 2.29%

-

Britain’s 10-year yield declined seven basis points to 4.13%

Commodities

-

Brent crude rose 0.9% to $78.70 a barrel

-

Spot gold rose 0.4% to $2,037.82 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson, Chiranjivi Chakraborty, Jiyeun Lee and Toby Alder.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.