On June 18th, in what would have seemed completely unlikely only around a year or so before, Nvidia (NASDAQ:NVDA) briefly became the world’s most valuable company, reaching a market cap of $3.34 trillion and knocking Microsoft off the top spot.

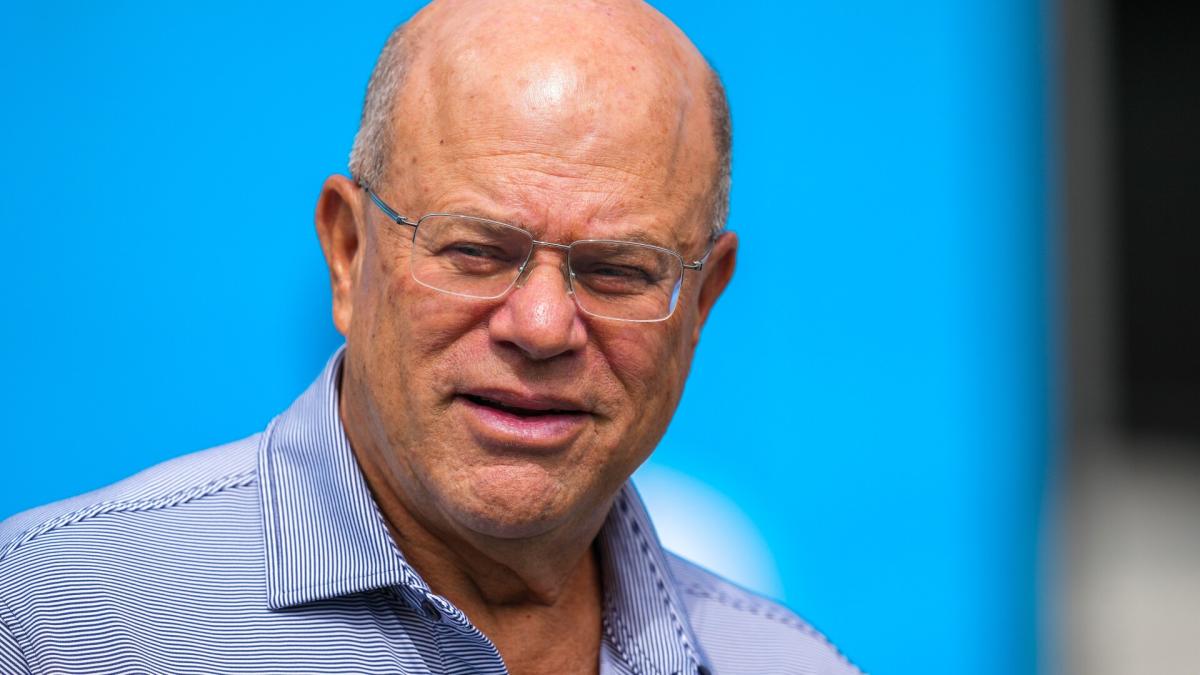

Following this significant milestone, Truist’s William Stein, an analyst ranked 4th among the thousands of Wall Street stock pros, pointed out that investors started wondering if the AI chip giant could keep up its strong performance.

His conclusion? “A thorough analysis of the data suggest that becoming the largest company by market cap does not appear to systematically challenge future investment returns,” Stein noted. “Specifically, four of the five other companies that became #1 since the Tech Bubble outperformed the S&P over the following five-year period.”

To outperform the S&P 500, a stock must either increase its P/E ratio at a quicker pace than the index, grow its EPS at a faster rate, or achieve both. While boosting the P/E ratio is straightforward to understand, growing EPS faster than the index necessitates excelling in one or more of these areas compared to the index: “(1) organic sales growth, (2) operating profitability (OPM), (3) non-operating profitability (below the line items), (4) inorganic growth, or (5) share count reduction (buybacks).”

So how does Stein think Nvidia will keep on beating the S&P? Well, further multiple expansion (currently 44x NTM EPS) looks to be “highly unlikely,” the OPM (approaching 70%) has limited room for improvement, large acquisitions would likely encounter intense scrutiny and thus may not have much of an impact, and while buybacks are effective, they are unlikely to yield substantial returns on account of the current P/E multiple.

That leaves “the old-fashioned way: earnings growth, via organic sales growth,” which Stein considers the “only reliable method.”

So, what does this all mean for investors? Stein rates NVDA shares a Buy, along with a $140 price target, implying there’s room for modest growth of 8% over the coming months. (To watch Stein’s track record, click here)

The Street’s average target is in line with Stein’s objective. Rating wise, 36 other analysts are bullish too, with 4 additional Hold (i.e. Neutral) ratings not enough to spoil the stock’s Strong Buy consensus rating. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.