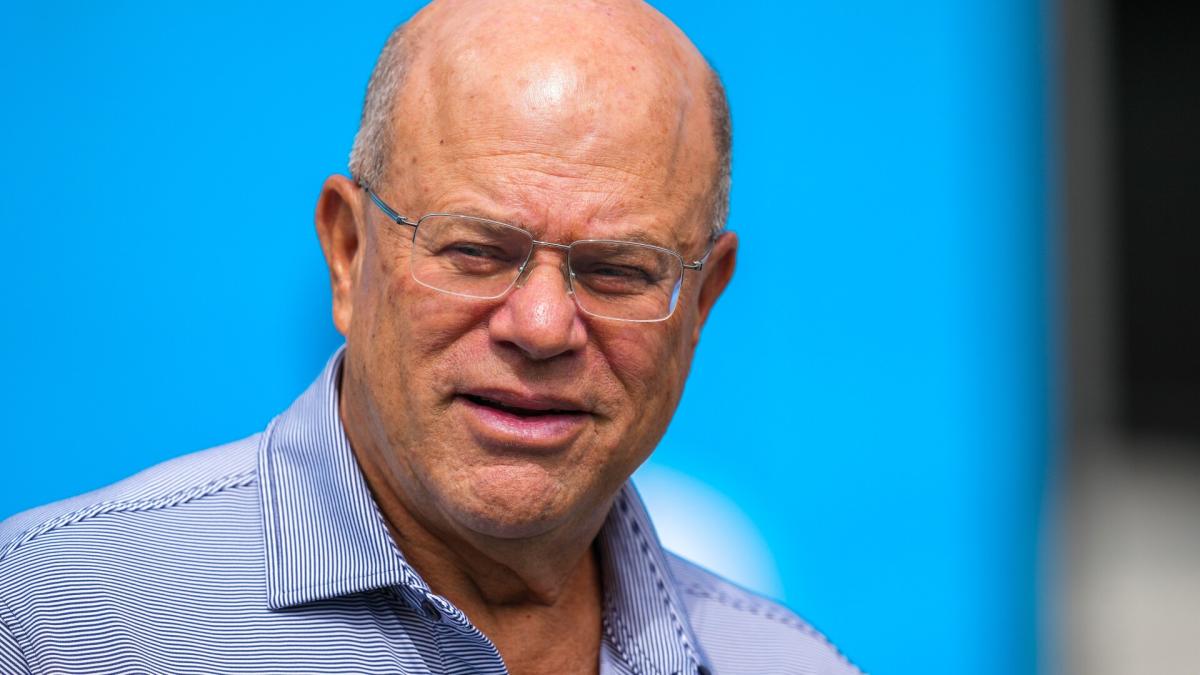

(Reuters) — Media veteran Edgar Bronfman Jr on Monday withdrew from the race for Paramount Global (PARA), clearing the way for Skydance Media to take control of Shari Redstone’s media empire and ending one of the most chaotic media bidding wars in recent history.

In a statement, Bronfman said his bidding group had informed Paramount’s special committee on Monday evening of its decision to drop out of the process.

“We continue to believe that Paramount Global is an extraordinary company, with an unrivaled collection of marquee brands, assets and people,” Bronfman said in a statement. “While there may have been differences, we believe that everyone involved in the sale process is united in the belief that Paramount’s best days are ahead.”

The special committee of Paramount’s board said in a statement that it had concluded the “go shop” period, in which it contacted more than 50 parties to evaluate their interest in acquiring the media company. The company expects the deal with Skydance to close in the first half of 2025, pending regulatory approval, it said.

Bronfman was unable to come up with the equity financing package that was required for his bid, said a source familiar with the matter. A few of Bronfman’s key equity partners on the deal dropped out at the eleventh hour, scuttling any hope he had of mounting a serious challenge to the Skydance bid, the source added.

Last week, a Bronfman-led investor group had proposed to take control of Paramount through a $6 billion bid, in which it would buy the media firm’s controlling shareholder, National Amusements.

That offer for Paramount – home to its namesake film studio, the CBS broadcast network and cable networks such as Nickelodeon and Comedy Central – had threatened to derail an $8.4 billion agreement reached by Paramount and Skydance in July.

“Having thoroughly explored actionable opportunities for Paramount over nearly eight months, our Special Committee continues to believe that the transaction we have agreed with Skydance delivers immediate value and the potential for continued participation in value creation in a rapidly evolving industry landscape,” said Charles Phillips Jr., chair of Paramount’s special committee.

A spokesperson for Redstone, who owns National Amusements, could not immediately be reached for comment. Skydance declined to comment.

Bronfman’s bid relied on participation of high net worth individuals, some of whom were disconcerted seeing their names appear in news stories about the offer, said two people with knowledge of the process.

One of the people said that after commitments from at least one party failed to come through, Bronfman and the team scrambled to replace the financing, but ran out of time.

The veteran media executive elected to withdraw from the bid process, rather than submit an offer to Paramount’s special committee that the team knew would be rejected, one of the sources said.

(Reporting by Kanjyik Ghosh and Dawn Chmielewski; Editing by Sandra Maler and Sayantani Ghosh)

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.