(Bloomberg) — Hewlett Packard Enterprise Co. shares surged as much as 16% to trade at a record high after the company reported better-than-expected revenue fueled by sales of servers built for artificial intelligence work.

Most Read from Bloomberg

Fiscal second-quarter revenue increased 3.3% to $7.2 billion, the company said Tuesday in a statement. Wall Street projected a 2% decline year over year to $6.82 billion, according to data compiled by Bloomberg. Profit, excluding some items, was 42 cents per share in the period ended April 30. Analysts, on average, estimated 39 cents.

The strong performance was due to the company’s server business, which generated revenue of $3.87 billion. Analysts, on average, estimated $3.45 billion. Sales of AI-oriented systems doubled from the first quarter to more than $900 million, the company said. Increased demand and better availability of high-powered semiconductors from Nvidia Corp. led to the increase in AI systems sales, Chief Executive Officer Antonio Neri said in an interview.

The shares rose 16% to a high of $20.43 Wednesday after closing at $17.60 in New York. That’s the biggest intraday gain since March 2016 and the highest the stock has traded since HPE’s 2015 split from personal computer-oriented HP Inc.

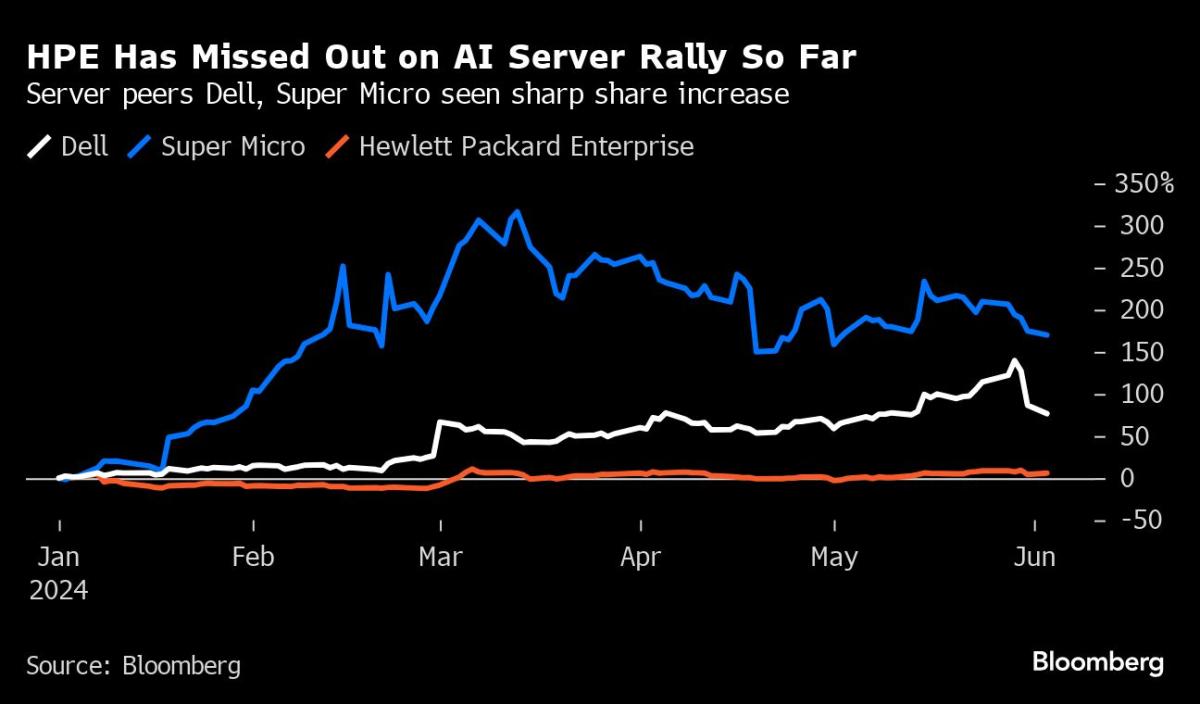

Shares of HPE have risen just 3.7% through Tuesday’s close, a modest increase compared with its peers in the server space, including Dell Technologies Inc. and Super Micro Computer Inc., whose shares have jumped 77% and 171%, respectively, over the same period.

“I think the market will start waking up about this,” Neri said of HPE’s AI server business. “I think after today’s announcement, they will understand even more.”

HPE’s current backlog for AI systems is now $3.1 billion, Chief Financial Officer Marie Myers said on a conference call after the results were released. Dell said last week its AI server backlog was $3.8 billion.

This is the first quarter HPE has broken-out AI server revenue “and investors likely welcome the increased disclosure,” wrote Simon Leopold, an analyst at Raymond James.

Sales will be $7.4 billion to $7.8 billion in the period ending in July, the company said. Analysts, on average, projected $7.45 billion. Profit, excluding some items, will be 43 cents to 48 cents a share, compared with an estimate of 46 cents.

For the fiscal year, HPE raised its revenue outlook to a gain of 1% to 3%, from a previous forecast of flat to 2% growth. The company said profit will be about $1.90 per share at the mid-point of its range, compared with a February forecast of about $1.87 per share.

“The AI-server ramp-up is finally materializing,” wrote Woo Jin Ho, an analyst at Bloomberg Intelligence. Still, the full-year forecast is underwhelming given the increased AI business, suggesting other business lines, such as networking, are dragging down the results, he said.

HPE’s Intelligent Edge, which includes the networking business, reported $1.09 billion in revenue in the second quarter, compared with the average estimate of $1.25 billion. In January, HPE agreed to buy Juniper Networks Inc. for $14 billion in a move that will boost its networking offering. Neri said he expects improvement in customer demand as the year goes on.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.

:max_bytes(150000):strip_icc()/family-affair-3-062724-483072a9ff1f4f2b9e64c3f3f0849738.jpg)