If you’re like most investors, you love the market’s long-term upside. You just don’t want to suffer its occasional (and sometimes painful) setbacks. Problem? You don’t know when crashes are coming. The best you can hope for is minimizing their misery once they arrive. And the best way to do that is by being properly positioned before big pullbacks take shape.

With that as the backdrop, there’s one name in particular I’d consider owning now just in case a market crash is looming. That’s Annaly Capital Management (NYSE: NLY).

Never heard of it? Don’t sweat it. You’re not alone. It’s not exactly a household name, and with a market cap of only $10 billion, it’s not like it garners a great deal of the financial media’s attention.

It does its job for investors incredibly well, though.

What’s Annaly Capital Management?

Annaly Capital Management is a real estate investment trust (REIT). Just as the name suggests, REITs are real estate-focused organizations. REITs own properties ranging from hotels and office buildings to strip malls, apartment buildings, and more. Their primary purpose, however, is the same in all cases: generating reliable, recurring income for shareholders.

Annaly is unique even by REIT standards, though. Rather than holding rent-bearing or revenue-bearing real estate, this company’s business is a combination of managing mortgage loan service rights, buying and selling mortgage-backed securities issued by government agencies, like Fannie Mae or Freddie Mac, and what is essentially engaging in interest rate arbitrage between its own borrowing costs and the yields on the mortgage-based securities it holds.

It sounds crazy, and in some ways it is. The business model is 100% tethered to the United States mortgage market, which ebbs and flows in relation to ever-changing interest rates. Sometimes, this business is predictable. Other times, it isn’t. And sometimes, even when it is predictable, that doesn’t necessarily mean there’s an easy way for a mortgage REIT to defend itself against looming setbacks.

At the end of the day, though, Annaly Capital Management makes it work. Since its inception in 1996, this REIT’s total return has kept up with the S&P 500‘s gain for the same timeframe, with most of Annaly’s net gains coming in the form of what’s usually an oversized dividend that continues being paid, even when the broad market is on the ropes.

An advantageous disconnect

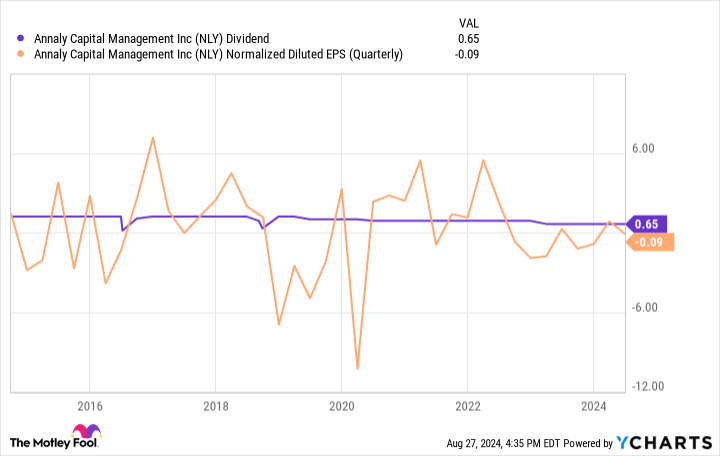

Don’t misread the message. For anyone needing consistent, predictable investment income, Annaly Capital Management can be a rather tough ticker to count on. The payout doesn’t necessarily grow in step with inflation, if it grows at all. Sometimes, it shrinks, reflecting the ongoing changes in the underlying mortgage loan market within which this REIT solely operates. This ticker’s price changes — often being lowered — to make its yield more accurately reflect the prevailing, risk-adjusted yields at any given time.

The REIT’s underlying earnings (called earnings available for distribution) are also impacted by changes in interest rates themselves, which can force the organization to adjust its dividend payments from time to time.

Annaly Capital Management is still a great defensive option in the event of market crashes, though, for a couple of different but related reasons: (1) This business doesn’t necessarily rise and fall with the stock market’s ebb and flow, and (2) the dividend behind Annaly’s current yield of 13% is going to be paid regardless of the market’s performance in the foreseeable future.

That’s better than the S&P 500’s average annual gain, by the way.

To be clear, owning a stake in this REIT doesn’t guarantee you’ll be better off than not should stocks suffer a sizable pullback. There are no guarantees in this business, after all. Anything can and will eventually happen.

But that’s not the point. The most you can do is give yourself the best chance of fending off the full brunt of a sweeping sell-off. Annaly at least offers you a reasonable chance of doing that. In the meantime, it’s dishing out a good amount of cash in an environment where growth stocks may not be logging a great deal of gains for a while.

Keep it in perspective

The defensive benefits here are obvious, but even so, interested investors should keep things in perspective. Annaly isn’t well suited to serve as a major, foundational holding in a long-term portfolio. And if your current goal is just to survive a market crash, you should think about picking up other kinds of defensive trades, like gold or bonds.

Nevertheless, Annaly Capital Management is a top prospect for at least a small sliver of your portfolio right now, if only because it’s so far removed from the mainstream stock market yet still capable of producing stock market-like net returns.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? Who Knows? That’s Why I’d Own This High-Yield Dividend Stock. was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.