As many as 2,450 autoworkers at Stellantis NV’s Warren Truck Assembly Plant could be laid off indefinitely in early October as the plant’s general assembly moves to a one-shift operation from two with the end of production of the Ram 1500 Classic pickup, the automaker said Friday.

The layoff notice comes as United Auto Workers leaders and analysts say the automaker is planning to take overflow production of Ram trucks at nearby Sterling Heights Assembly Plant to Mexico, rather than handling that excess work at Warren Truck. Stellantis spokesperson Jodi Tinson said a decision on overflow production hasn’t been announced.

The plant will continue to produce the Jeep Wagoneer and Grand Wagoneer SUVs.

“We knew it was coming, but to actually find out that it’s reality is scary, to say the least,” said Candace Watts, 37, who has worked at the plant for a decade and serves on the executive board for UAW Local 140, which represents workers at the plant. The mother of two said she’s uncertain if she’ll be among those cut, adding a membership meeting is scheduled for later this week.

Just two days ago, Warren Truck workers had gathered on Belle Isle for a picnic to vent and talk about the layoff rumors and discuss their options. They called the gathering the “140 Layoff Barbecue.”

“It was a beautiful experience. We all got together and enjoyed each other’s company,” Watts said. Two days later, those same workers started receiving robocalls announcing the mass layoff.

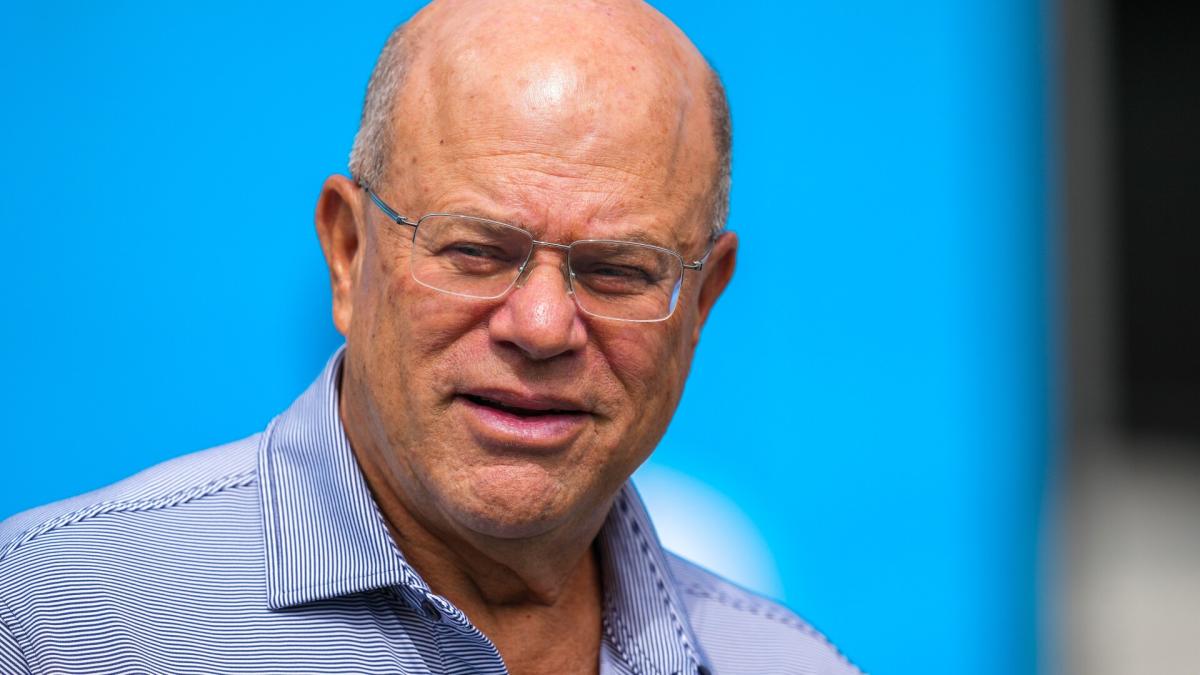

Howard P. Watson, 57, a 30-year employee from Detroit, is no stranger to the ups and downs of the auto industry. When he heard about the shift cut Friday morning, he said he was concerned for the younger employees who face layoffs. Watson said with his level of seniority, he expects to keep his job.

“It really wasn’t a shock to me because we’ve been doing this roller coaster thing in the auto industry for years,” he said. “But when I heard it, I thought about the younger people and how it’s going to affect them.”

Watson said workers with higher seniority will be able to move to the remaining shift and that those with less seniority are likely to face layoffs.

“With the young folks, you can kind of hear the wind being knocked out of them,” he said.

Stellantis on Friday filed a worker adjustment and retraining notification about the Warren layoffs with the state, local government and the UAW. The job cuts — likely to be lower than the total in the WARN letter — are expected to begin as early as Oct. 8 or two weeks after that. The plant employs approximately 3,900 people, including about 3,700 UAW-represented employees.

“It’s been in discussions for some time,” UAW Local 140 Vice President D Robinson said of the layoff. “It really was not much of a surprise for me. We hate to see it happen, but we did know the possibility was out there.”

The plant has already been running on a single shift since early last month due to lower orders for the Wagoneer and Grand Wagoneer. First and second-shift workers have rotated through temporary layoffs for a week or two, then worked for a week or two. This week, there were no scheduled production shifts at the plant due to low orders, Robinson said.

Stellantis expects the plant will remain on one shift of production until the job cuts are permanent in October, Tinson said. There are no plans to add a new vehicle that would be produced at Warren Truck, she said.

More: Stellantis reports steep first-half profit decline amid weak sales

UAW President Shawn Fain slammed the cuts in a Friday statement, calling Stellantis CEO Carlos Tavares “a disgrace and an embarrassment to a once-great American company,” pointing to its disappointing recent financial results and sales.

“The American taxpayer has invested in Stellantis. Workers have invested in Stellantis. Consumers have invested in Stellantis. It’s time for Stellantis to invest in us,” Fain said. “We have been clear in private and in public with Stellantis that Tavares’s mismanagement of this company and his lack of commitment to the American autoworker is unacceptable.”

Wagoneer should keep ‘lights on’

Stellantis launched a refreshed version of the Ram 1500 truck for the 2025 model year at the Sterling Heights plant. When it debuted the fifth generation of the pickup for 2019, the company said it would continue to build the previous generation as a “Classic” for value-focused buyers and extended its production longer than expected.

“The Ram 1500 Classic has been a great entry point pickup for Ram and the Tradesman model has well represented the needs of commercial truck customers for years,” the company said in a statement sent by Tinson. “We introduced the new 2025 Ram 1500 Tradesman with incredible value and content.”

Indefinitely laid-off represented seniority employees will receive 52 weeks of company-provided supplemental unemployment benefits, 52 weeks of transition assistance and two years of health-care coverage. That would be in addition to state unemployment benefits. The cuts impact workers from Locals 140, 412 and 880, the WARN notice said, and some workers will have so-called “bumping rights” where they could find work in other Stellantis plants.

Other operations outside of general assembly within the plant, like the paint shop, will remain on two shifts to support Wagoneer production. Stellantis sold almost 30,000 Wagoneers in the first half of the year, up 119% year over year, and close to 7,600 Grand Wagoneers, up 43%. Stellantis, which does not break out 1500 Classic sales, sold 179,526 Ram pickups in the first half of 2024, down 20% year over year.

In the record UAW contract with Stellantis that expires in 2028, the automaker committed $400 million to the plant for mid-cycle refreshes, range-extended models and all-electric versions of the full-size Jeep SUVs.

Since the big Jeep SUVs are expensive, profitable vehicles, that’ll keep Warren’s lights on — for now, said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions LLC.

“It’s important to the Jeep lineup and Stellantis overall,” he said. “Unless they can find room for it somewhere, Warren could be retooled to be at lower volumes and to keep its profitability.”

Production in Mexico

UAW leaders at the plant, including Robinson and Local 140 President Eric Graham, have argued that Warren Truck should get any overflow work from Sterling Heights producing Ram 1500s. If they did receive that work, they believe they could maintain a second shift. But Graham said it appears that the Ram overflow will instead head to a plant in Mexico, the Saltillo Truck Assembly Plant, which builds several other Ram vehicles.

UAW executives, including Fain, have also mentioned in recent letters that overflow production is likely headed to Mexico and not Warren. Warren Truck has a long track record of building Ram 1500s and is about a 15-minute drive from the Sterling Heights plant.

The UAW has powers it can leverage when it comes to disagreements with companies, whether it is raising health and safety issues at a key plant or striking at a plant that doesn’t have a local agreement, said Marc Robinson, principal of consultancy MSR Strategy and a former General Motors Co. internal consultant who was involved in labor negotiations. The union, in the spring, threatened to strike at Warren Stamping Plant over local contract negotiations.

The union “has made a conscious decision to not be more or less friendly with the companies, not to be polite,” Robinson said. “Shawn Fain hasn’t had a good couple of months with the (organizing) defeat at the Alabama plant and the federal overseer raising questions around the union corruption. It’s going to be interesting to see how he responds, whether he goes for maximum confrontation or verbal attacks.”

He added that there were several reasons a company might choose to place a product in a Mexico facility, including a large cost advantage.

“That cost advantage has increased since the UAW contract was signed,” Robinson said. “The union would view the Ram 1500 as something that they so-call ‘own,’ since it’s been produced by them, and there’s not a major change in it. They would say you’ve got to produce it in the U.S. A decision to send the overflow production to Mexico instead of Warren and to lay off Warren workers would not be a friendly act with regard to the UAW.”

Stellantis last year signed a record, more-than-four-year contract with the UAW featuring 27% compounded wage hikes, the reintroduction of cost-of-living adjustments, fewer pay tiers, increased retirement benefits and reforms seeking to address high absenteeism rates at plants like Warren and Sterling Heights. Autoworker compensation across the industry in Mexico is a fraction of what U.S. employees receive, a reflection of a lack of independent unions and government policies there, said Harley Shaiken, a University of California-Berkeley professor emeritus who specializes in labor and the global economy.

“Under any circumstances, laying off more than 2,000 people is very painful, not simply for the workers and their families, but for the communities in which they live,” Shaiken said. “This a tough situation. But where you have overflow at the Sterling Heights Assembly Plant going to Mexico, that’s adding outsourcing. That’s proved to be a very explosive political combination in part because it highlights a very large trend that has always been a problem for the UAW and autoworkers.”

Mexico, he noted, continues to draw billions of dollars in investments, including for electric vehicles. Now, Chinese companies like BYD Co. Ltd. are looking at producing vehicles there as well, augmenting fears of low-cost EVs entering the U.S. market from new competitors.

“The much-vaunted USMCA that Trump keeps trumpeting is not in any way effectively addressing this situation,” Shaiken said, referencing the U.S.-Mexico-Canada trade agreement signed in 2018 under former president Donald Trump that replaced the North American Free Trade Agreement. “I suspect we’ll see bargaining about it, and in an election year, a very sharp political response, as well.”

In a statement, Victoria LaCivita, Michigan communications director for Trump’s campaign, said layoff announcements like the one in Warren would be more common under an administration run by Vice President Kamala Harris, the Democratic nominee for president, and her running mate, Minnesota Gov. Tim Walz.

Under President Joe Biden, the country has instituted aggressive greenhouse gas tailpipe emission and fuel economy standards. Despite Trump calling them an “EV mandate,” the regulations are “technology neutral” and don’t prescribe a certain percentage of vehicles automakers sell to be all-electric. Analysts and industry executives, however, have said they will need to sell EVs to be compliant with the rules.

“Their EV government mandates and radical energy policies will continue to decimate the auto industry, eliminating Michigan jobs and hurting our economy,” LaCivita said. “This is what’s on the line in November, and why voters are going to send President Trump back to the White House.”

The News on Friday afternoon requested comment from the White House and the Harris presidential campaign.

Each automotive assembly job has a big multiplier effect on employment in their communities, from automotive suppliers to bars and restaurants in town. Bridgewater Interiors at the end of July also filed a WARN, disclosing the layoff of 63 employees around Sept. 30 at a facility in Detroit. UAW Local 600 President Tony Richards said those are related to the job cuts at Warren.

When Warren Truck goes down, Motor City Sports Bar & Grill across Mound Road from the Stellantis plant sees a 60% drop in business, owner Maria Nuculaj said. The layoffs are more bad news for business after ups and downs in production in recent months at the plant and the higher cost of living resulting in customers cutting out luxuries.

“It hurts all the businesses,” Nuculaj said. “There’s a domino effect. Everyone will feel it. It’s been changing a lot lately, and not in a good direction. At noon, we’ve had one customer in here when we used to have a whole counter of people trying to eat lunch. And now, nobody.”

She said slower business means her own layoffs and having to take on shifts herself. It all reflects the state of the economy, she said, and affects how she is thinking about the presidential election in November.

“Free trade should change,” Nuculaj said. “Jobs should stay here. People that are making the cars are not able to afford them, because they are getting outsourced to Mexico.”

Why Classic production is ending

Vehicle pricing and mix also has been a unique challenge for Stellantis in North America, increasing inventory on dealer lots and drawing criticism from its retailers in recent months.

The Ram 1500 Classic starts at $38,705, according to Stellantis’ website. The ’25 Ram 1500 starts at $39,420.

Stellantis has highlighted the Hurricane Straight Six Turbo engine on the freshened vehicle for improved fuel efficiency to lower the cost of ownership, an upgraded electrical architecture for technologies that support commercial fleet tracking and safety systems like Forward Collision Warning Plus and Adaptive Cruise Control, and a platform that offers electrification opportunities. That platform will be used on the all-electric Ram 1500 REV and the Ramcharger, battery-powered with an onboard gas generator, set to launch before the end of the year and early next year, respectively. Without upgrading the Ram 1500, those options wouldn’t have been available to enable future compliance with fuel economy and emissions regulations, according to the company.

Removing the Classic will allow the dealers to catch up on sales and reduce their stock to more reasonable levels, Fiorani said.

For years, the automaker has said it’s planning to launch a midsize pickup, one of the reasons it offered the less-expensive Classic in the first place to offset the gap in its portfolio of a smaller, lower-cost truck. Stellantis in its contract with the UAW committed to a $1.5 billion investment at the idled Belvidere Assembly Plant in Illinois to produce a midsize truck in 2027, though communications from the union have suggested that launch has been pushed out to 2028.

“The popularity of the revived (Ford) Ranger and (Chevrolet) Colorado alongside the high-volume full-size truck in the same dealership show there is need for pickup trucks below full-size,” Fiorani said. “Add in models like (the Ford) Maverick that have blown out the market, Ram may be missing out on considerable sales.”

@BreanaCNoble

@lramseth

Staff Writer Candice Williams contributed.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.