Netflix is expanding its viewership data transparency with the release of its first biannual report covering six months of streaming habits on the platform, revealing for the first time how licensed content like USA Network drama “Suits” performs alongside the streamer’s originals.

Included in the new report, titled “What We Watched: A Netflix Engagement Report,” which covers more than 18,000 titles — which Netflix says represents 99% of all its viewing — and nearly 100 billion hours viewed between January-June 2023 are: 1) hours viewed for every title, both Netflix original and licensed TV shows and movies, watched for over 50,000 hours during that period; 2) the premiere date for any Netflix original TV series or film; and 3) whether a title was available globally.

Each piece of that information is key here, because these findings aren’t as cut and dry as Netflix’s weekly Top 10 reports and “Most Popular” lists. For example, at the top of this report is “The Night Agent,” a series that debuted globally March 23 and racked up 812 million hours viewed by the end of June. And at No. 3 is “Wednesday,” Netflix’s top English-language series of all time, not because it was a less popular series, but because it came out in November of 2022, and a good chunk of its massive audience had already completed the show come January when this report began.

Additionally, this report focuses on hours viewed vs. Netflix’s new favored way of representing its weekly Top 10 lists, which is by estimated viewers. However, Netflix says that more than 60% of its titles released between January and June 2023 appeared on our weekly Top 10 lists, so you will see a large amount of crossover between titles on the report and the standing week-to-week rankings.

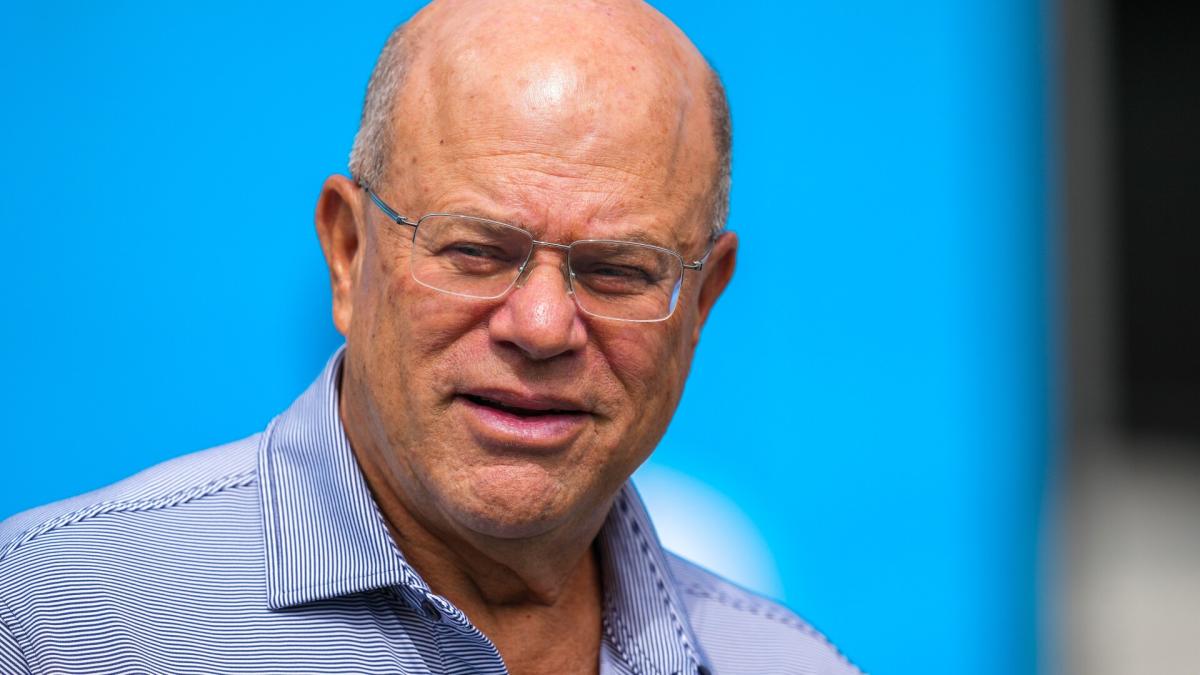

During a press call with reporters Tuesday, co-CEO Ted Sarandos and vice president of strategy and analysis Lauren Smith fielded questions about the findings, noting that they plan to release their next biannual report covering the June-December period in the new year. (So be on the lookout for “Suits” to really pop in that data, as its surge began over the summer.)

“I’m the co-CEO of a public company, so sharing bad information has consequences,” Sarandos said in response to Variety‘s question on the call about having the data audited by a third party or presenting it to the Media Ratings Council. “So this is the actual data that we use to run the business. And in terms of the requirements for things like advertising, Nielsen does require third-party validation on those things. But this is our data, and it is our accurate data. It’s the data that we use to run the business that we’re sharing with you. Us compiling the data to provide to a third party to provide it to you seems like a lot of steps of something that’s already a pretty heavy lift.”

Sarandos noted that, despite the fact viewership data transparency was a key negotiation point in the recent writers and actors strikes, that was not the main factor that contributed to Netflix releasing this new report.

“This has been on a continuum for several years,” the co-CEO said. “So this is not driven by anything differently than that. I think it’s really important, that’s why I did say earlier, that lack of data, lack of transparency, the unintended consequence was this kind of mistrust, this environment of mistrust around the data. So this is probably more information than you need, but I think it creates a better environment for the guilds, for us, for the producers, for creators and for the press.”

See below for the findings from the “What We Watched: A Netflix Engagement Report” that were specifically highlighted by Netflix, each in the streamers own words:

The strength of returning favorites like Ginny & Georgia, Alice in Borderland, The Marked Heart, Outer Banks, You, Queen Charlotte: A Bridgerton Story, XO Kitty and film sequels Murder Mystery 2 and Extraction 2

The popularity of new series like The Night Agent, The Diplomat, Beef, The Glory, Alpha Males, FUBAR and Fake Profile, which generate huge audiences and fandoms

The size of the audience of our films across every genre including The Mother, Luther: The Fallen Sun, You People, AKA, ¡Que viva México! and Hunger

The enthusiasm for non-English stories, which generated 30% of all viewing

The staying power of titles on Netflix, which extends well beyond their premieres. All Quiet on the Western Front, for example, debuted in October 2022 and generated 80M hours viewed between January and June

The demand for older, licensed titles, which generates tremendous value for our members and for rights holders.

Laura Davis is an entertainment aficionado who delves into the glitz and glamour of the entertainment industry. From Hollywood to Broadway, she offers readers an insider’s perspective on the world of movies, music, and pop culture.