DigitalOcean Holdings (NYSE: DOCN) may not be a popular name in the cloud computing space when compared to the likes of Microsoft and Amazon, and that’s not surprising as it is currently in its early phases of growth.

Founded in 2012, DigitalOcean isn’t a cloud service provider in the mold of its more illustrious peers. The company is known for providing an on-demand cloud computing platform that’s used by small businesses, developers, and start-ups, and it has been struggling in the past year because of weak cloud spending. This explains why DigitalOcean stock has gained just 15% in the past year, which is well below the Nasdaq Composite index’s 42% gains.

However, a closer look at the company’s prospects and its attractive valuation suggests that it could indeed step on the gas in the future. Let’s see why that may be the case.

DigitalOcean is facing challenges, but investors should focus on the bigger picture

DigitalOcean released its fourth-quarter 2023 earnings report on Feb. 21. The company’s annual revenue increased 20% year over year to $693 million, while adjusted earnings were up an impressive 75% to $1.59 per share. However, a look at DigitalOcean’s Q4 results suggests that the company is struggling due to tight spending by customers.

The company’s fourth-quarter revenue was up just 11% year over year to $181 million. Its average revenue per user (ARPU) increased only 6% from the year-ago period. Also, DigitalOcean’s net dollar retention rate of 96% suggests that existing customers reduced spending on its offerings. This metric was down from a reading of 112% in the year-ago quarter.

The net dollar retention rate compares the spending from its customers in the year-ago period to the spending by the same customer cohort at the end of the current period. So, a reading of less than 100% suggests that spending contracted.

CEO Paddy Srinivasan admitted on the company’s latest earnings conference call that DigitalOcean “begins 2024 having weathered a challenging macro demand environment where, like many large platform providers, top-line growth slowed from historical highs.” This explains why the company’s outlook for 2024 points toward a slowdown.

DigitalOcean expects $765 million in revenue this year, which would be an increase of just over 10% from 2023 levels. It expects earnings to land at $1.64 per share at the midpoint, which would be a big drop in growth from last year. DigitalOcean management, however, is focusing on the long-term growth opportunity available in the market it serves.

The company aims to win a bigger share of customers’ wallets by improving customer engagement and integrating new solutions such as artificial intelligence (AI) and machine learning (ML) into its cloud computing platform.

DigitalOcean’s acquisition of Paperspace last year could help the company revive customer spending and bring new customers into its fold. Paperspace gives users access to cloud infrastructure accelerated by graphics processing units (GPUs) so that they can train, test, and deploy AI/ML applications. DigitalOcean claims that Paperspace will help its customers access “AI and machine learning-centric cloud applications that harness the power of GPUs in ways that have been predominantly available only to large enterprises.”

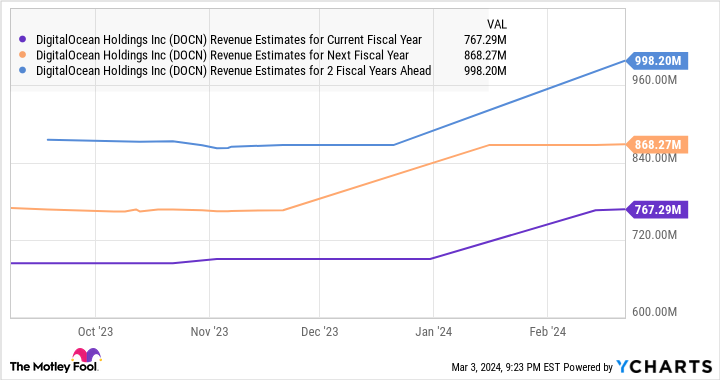

It is worth noting that the AI-as-a-service market is currently in its early phases and generated $11.3 billion in revenue last year, according to Grand View Research. The researcher expects this market to generate a whopping $105 billion in revenue by 2030. Investors, therefore, can expect DigitalOcean to regain its mojo in the future. The good part is that analysts are anticipating an acceleration in the company’s revenue growth from 2025.

DOCN Revenue Estimates for Current Fiscal Year data by YCharts

The stock could step on the gas

Once DigitalOcean’s growth starts improving, it won’t be surprising to see the stock get a shot in the arm and deliver healthy gains to investors in the long run. As seen in the previous chart, analysts have raised their revenue expectations for DigitalOcean this year and expect its top line to get close to $1 billion in 2026.

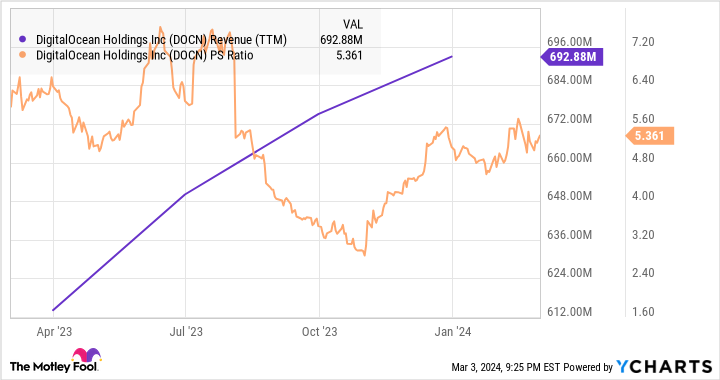

The stock is trading at 5.3 times sales, which seems attractive relative to the revenue growth it has been clocking.

DOCN Revenue (TTM) data by YCharts

The market may reward DigitalOcean with a higher sales multiple if its growth indeed accelerates. But even if it trades at its current sales multiple after three years and generates $1 billion in revenue, the company’s market cap could increase to $5 billion — a 43% jump. That’s why investors looking to buy a cloud stock that could deliver healthy long-term gains may want to take a closer look at DigitalOcean before it starts heading north.

Should you invest $1,000 in DigitalOcean right now?

Before you buy stock in DigitalOcean, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DigitalOcean wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, DigitalOcean, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Little-Known Cloud Computing Stock to Buy Hand Over Fist Before It Soars 43% was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.