-

Revenue: $12.6 billion, 6% higher than the March quarter 2023, aligning with estimated revenue of $12568.1416 million.

-

Earnings Per Share (EPS): Reported $0.45, aligning with estimated earnings per share of $0.3553.

-

Net Income: Reported pre-tax income of $380 million, compared to estimated net income of $221.443 million.

-

Operating Margin: Achieved 5.1% in adjusted operating margin.

-

Free Cash Flow: Generated $1.4 billion in free cash flow.

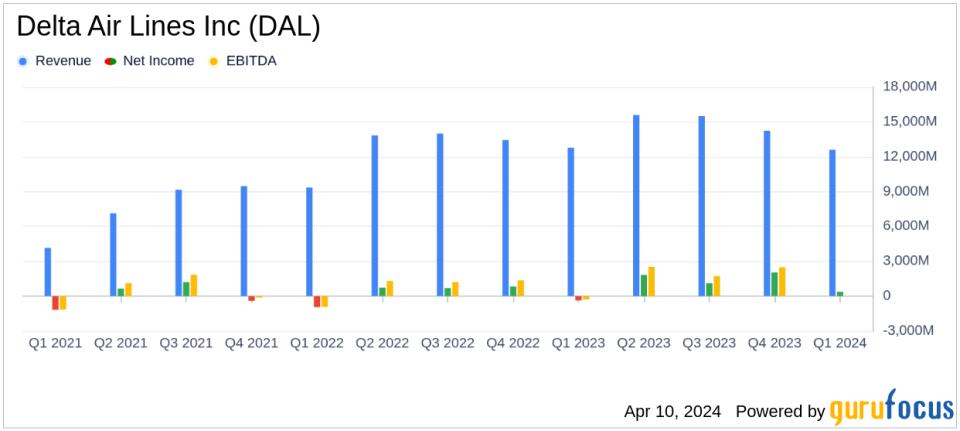

On April 10, 2024, Delta Air Lines Inc (NYSE:DAL) released its 8-K filing, announcing its financial results for the March quarter of 2024. The Atlanta-based airline, which operates over 300 destinations in more than 50 countries, reported operating revenue of $13.7 billion on a GAAP basis and $12.6 billion on an adjusted basis, marking a 6% increase compared to the same quarter in the previous year. This performance aligns with analyst revenue estimates of $12568.1416 million.

Delta Air Lines Inc (NYSE:DAL) achieved an adjusted earnings per share of $0.45, consistent with analyst projections of $0.3553. The company’s pre-tax income stood at $380 million, surpassing the estimated net income of $221.443 million. Delta’s adjusted operating margin reached 5.1%, reflecting strong earnings growth. The airline also generated a robust free cash flow of $1.4 billion during the quarter.

Operational Excellence and Financial Achievements

Ed Bastian, Deltas CEO, highlighted the airline’s operational reliability and the recognition of employee efforts with $1.4 billion in profit-sharing payouts. Delta expects to continue its momentum with a forecast of record revenue, a mid-teens operating margin, and EPS of $2.20 to $2.50 for the June quarter, reiterating its full-year outlook for EPS of $6 to $7 and free cash flow of $3 to $4 billion.

Delta’s financial achievements are particularly significant in the transportation industry, where operational efficiency and customer satisfaction are critical for success. The company’s strong performance is a testament to its strategic focus on operational excellence and customer experience, which are vital for maintaining competitiveness and profitability in the sector.

Financial Performance Details

The adjusted financial results for the March quarter include an operating income of $640 million and a pre-tax income of $380 million, resulting in a pre-tax margin of 3.0%. The adjusted earnings per share of $0.45 reflect the company’s solid financial position. Delta also reported an operating cash flow of $2.5 billion and a return on invested capital of 13.8 percent.

Delta’s cost performance and outlook remain positive, with non-fuel unit costs only 1.5% higher than the previous year. The airline’s balance sheet strength is evident from the $1.4 billion in free cash flow generated after significant profit-sharing payments and reinvestments in the business. Delta’s adjusted debt to EBITDAR ratio improved to 2.9x, down from 3.0x at the end of 2023.

Revenue and Cost Outlook

Glen Hauenstein, Deltas president, reported record March quarter revenues, driven by strong operational performance and demand trends. Corporate travel demand saw a 14% year-over-year increase, with domestic unit revenues reaching a March quarter record. International passenger revenue was up 12% versus the March quarter 2023. Diversified revenue streams, such as Loyalty and Premium products, contributed significantly to the quarter’s success.

Looking forward, Delta expects total revenue growth of 5 to 7 percent for the June quarter, with non-fuel unit costs expected to increase approximately 2%, consistent with the full-year outlook for a low single-digit increase over 2023.

Delta Air Lines Inc (NYSE:DAL) continues to demonstrate financial resilience and operational strength, positioning itself favorably for the upcoming quarters. The company’s alignment with analyst EPS projections and revenue growth underscores its ability to navigate the challenges of the transportation industry successfully.

For more detailed financial information and future updates on Delta Air Lines Inc (NYSE:DAL), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Delta Air Lines Inc for further details.

This article first appeared on GuruFocus.

Daniel Miller is a sports fanatic who lives and breathes athletics. His coverage spans from major league championships to local sports events, delivering up-to-the-minute updates and in-depth analysis for sports enthusiasts.