(Bloomberg) — Equity markets in Asia look set to open higher Monday as fresh inflation data did little to alter views that the Federal Reserve will cut interest rates this year.

Most Read from Bloomberg

Stock futures for the Nikkei 225 index pointed higher, while trading is still closed in Australia and Hong Kong due to holidays. Contracts for US equities climbed in early Asian trading.

In China, the official manufacturing purchasing managers index expanded in March for the first time since September. The reading suggests that the world’s second-largest economy has maintained traction after a solid start to the year and may give policymakers more time to assess the impact of previous stimulus measures.

“The industrial sector seems to be resilient, partly helped by strong exports,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “If fiscal spending rises and exports remain strong, the economic momentum may improve.”

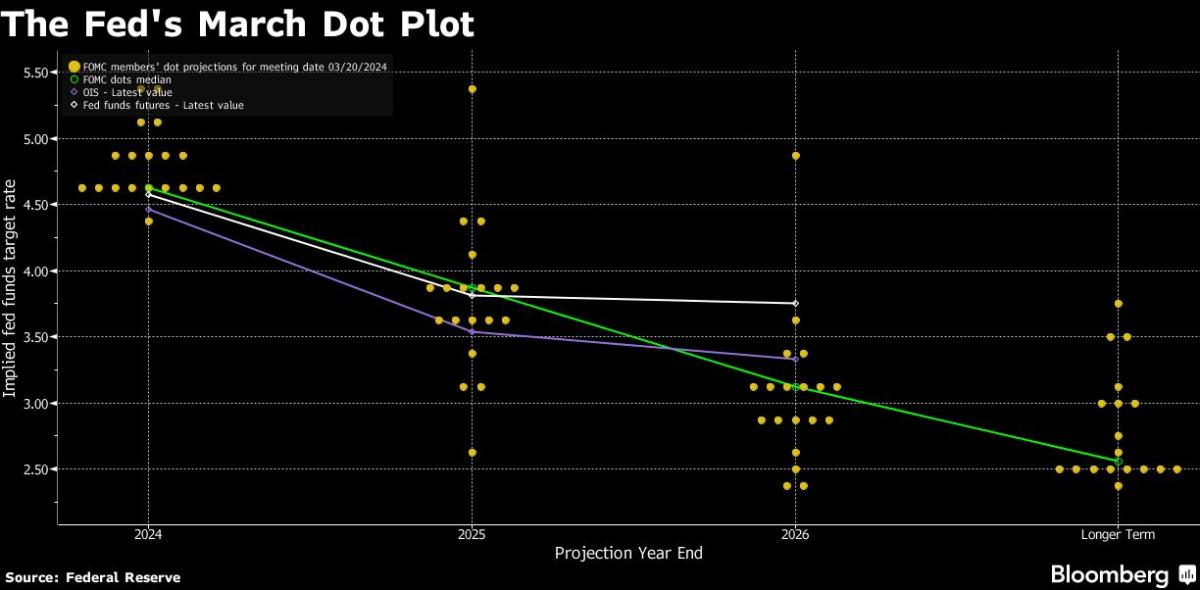

In the US, the Fed’s preferred gauge of inflation was “pretty much in line with our expectations,” Chair Jerome Powell said Friday, adding it wouldn’t be appropriate to lower rates until officials are sure inflation is in check. Investors are betting the US central bank will make that first cut in June.

The core personal consumption expenditures price index — which excludes volatile food and energy costs — rose 0.3% in February after climbing in the previous month, marking its biggest back-to-back gain in a year. The measure is up 2.8% from a year earlier, still above the Fed’s 2% target.

“You have a Fed that at the moment is highly data dependent,” said Matthew Luzzetti, chief US economist at Deutsche Bank. “Until we get either confirmation or a different view on what the data are going to be, it’s kind of hard to gauge exactly where we end up from a Fed policy perspective.”

Investors will also be keeping a close eye on Treasuries Monday as trading resumes during Asian hours. The dollar edged lower early Monday and was weaker against most currencies in a Group-of-10 peers.

Wall Street traders sent the S&P 500 to its 22nd record this year late last week. A $4 trillion surge in US equity values in just three months has startled doomsayers, while leaving a host of strategists scrambling to update their 2024 targets.

In commodities, gold edged higher while oil was little changed. Meanwhile, Bitcoin traded above $71,000. The largest digital currency has jumped almost 70% this year amid persistent demand for US exchange-traded funds holding the token.

Key events this week:

-

China Caixin manufacturing PMI, Monday

-

Indonesia CPI, manufacturing PMI, Monday

-

Japan Tankan business sentiment, manufacturing PMI, Monday

-

Macau casino revenue, Monday

-

Pakistan trade, CPI, Monday

-

Singapore home prices, Monday

-

South Korea trade, manufacturing PMI, Monday

-

Taiwan manufacturing PMI, Monday

-

Vietnam manufacturing PMI, Monday

-

US construction spending, ISM Manufacturing, Monday

-

Bank of Canada issues business outlook and survey of consumer expectations, Monday

-

Eurozone S&P Global Manufacturing PMI, Tuesday

-

France S&P Global Manufacturing PMI, Tuesday

-

Germany S&P Global / BME Manufacturing PMI, CPI, Tuesday

-

India HSBC/S&P Global Manufacturing PMI, Tuesday

-

Mexico international reserves, Tuesday

-

South Korea CPI, Tuesday

-

Spain unemployment, Tuesday

-

UK S&P Global / CIPS Manufacturing PMI, Tuesday

-

US factory orders, light vehicle sales, JOLTS job openings, Tuesday

-

Brazil industrial production, Wednesday

-

China Caixin services PMI, Wednesday

-

Eurozone CPI, unemployment, Wednesday

-

Japan services PMI, Wednesday

-

Hong Kong retail sales, Wednesday

-

US ISM Services, Wednesday

-

Eurozone S&P Global Services PMI, PPI, Thursday

-

India services PMI, Thursday

-

US initial jobless claims, trade, Thursday

-

Eurozone retail sales, Friday

-

France industrial production, Friday

-

Germany factory orders, Friday

-

Hong Kong PMI, Friday

-

India rate decision, Friday

-

Japan household spending, Friday

-

Philippines CPI, Friday

-

Russia GDP, Friday

-

Singapore retail sales, Friday

-

South Korea current account balance, Friday

-

US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0788

-

The Japanese yen was unchanged at 151.35 per dollar

-

The offshore yuan was little changed at 7.2558 per dollar

-

The Australian dollar rose 0.1% to $0.6528

Cryptocurrencies

-

Bitcoin rose 0.4% to $71,128.29

-

Ether rose 0.1% to $3,638.34

Bonds

-

The yield on 10-year Treasuries was unchanged at 4.20%

-

Japan’s 10-year yield advanced two basis points to 0.725%

-

Australia’s 10-year yield was unchanged at 3.96%

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.4% to $2,238.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.