Healthcare real estate investment trust Medical Properties Trust (NYSE: MPW) has been in the news a lot. The stock’s dividend has been popular with investors, but it suffered a significant cut in September.

It still yields nearly 13% at the new payout amount, which begs the question of whether you can trust the stock or if investors are headed for further trouble even with shares this low. The stock is down over 80% from its former high.

When looking at the facts, the best course of action is clear. Here is what investors need to know.

What happened to Medical Properties?

Medical Properties Trust is a real estate investment trust (REIT) in the healthcare sector and a big one at that. It rents out more than 44,000 beds through its 441 properties in the United States, United Kingdom, Europe, and Australia. This is a global company. REITs can be excellent dividend stocks because they pay at least 90% of their taxable income by design.

You could think of a REIT as a landlord in which you buy shares, so you don’t have to own properties yourself. But just like any real estate business, it doesn’t work if tenants don’t pay rent. The company’s largest tenant, Steward Health Care, has been experiencing financial hardship. This is a big deal because Steward was roughly 20% of Medical Properties’ revenue in the third quarter.

Its inability to pay rent had already forced Medical Properties to cut its dividend in August from $0.29 per share to $0.15. Earlier this month, Medical Properties provided an update that it was attempting to quickly reduce its exposure to Steward Health Care. In other words, it sounds like rather than riding out the situation, Medical Properties might believe it’s better off cutting its losses.

Medical Properties Trust stock has experienced most of its declines in the past year.

How bad is the damage?

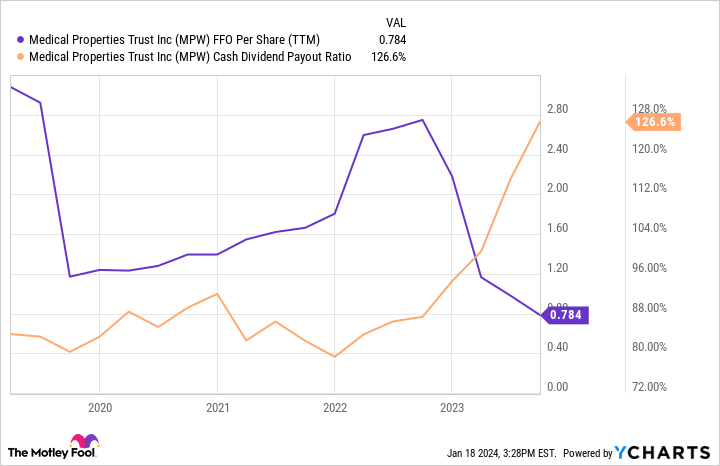

According to management’s January update, Steward Health Care owes approximately $50 million to Medical Properties. The fact that Steward accounted for a fifth of its revenue despite missing payments underlines how big a deal losing them will be. Below, you’ll see that the struggles sent Medical Properties’ dividend payout ratio soaring and tanked profits, noted as funds from operations for REITs:

The stock’s rapid decline puts investors in a tricky situation. The market can often panic, overreact, and send shares far lower than they might deserve. On the other hand, extracting money from Steward Health Care will likely require lengthy and potentially expensive lawsuits. Medical Properties has to turn around and find new tenants once it frees up the facilities.

Even after its fall cut, the stock’s dividend yields 13%, which signals that Wall Street isn’t confident Medical Properties is on solid ground yet. And, of course, another dividend cut could easily send shares lower yet, punishing anyone who tries to call a bottom on the stock too early.

What should investors do?

While 2023 was a disaster for the company, there is a chance Medical Properties Trust can rebuild its business over time. However, it may be unwise to rush in and buy the stock.

Management will cut the dividend as needed to keep its cash flow healthy enough to keep the business afloat. Additionally, over the next few years, more than 40% of its outstanding debt matures, requiring refinancing at potentially higher rates.

Yes, Medical Properties Trust could one day thrive again, but resolving its woes with Steward Health Care and rebuilding the business after that could take years, and nobody can predict the final extent of the damage. Therefore, treat Medical Properties as a very risky investment. That means keeping it at a very low percentage of your portfolio if you buy.

Consider dollar-cost averaging as well, buying slowly so that if more bad news comes up, you’re not fully invested and can roll with the punches.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Everyone Is Talking About Medical Properties Trust. Is It a Good Long-Term Option? was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.