Twenty years ago, a younger version of myself strolled the streets of Buenos Aires in search of a place to eat. I finally found a promising spot selling milanesa de carne sandwiches for 2 pesos. I can’t overstate the bargain. It was an incredible sandwich, and it only cost me about $0.66.

Back then, $1 was worth about three Argentine pesos. But today, $1 is worth nearly 900 pesos. In short, Argentine inflation has been relentless and detrimental to the country’s economy for years, making life hard for many hard-working Argentinians.

It’s hard for companies that do business in Argentina as well, which includes publicly traded MercadoLibre (NASDAQ: MELI). The company does business in multiple countries today, including Brazil and Mexico. However, it was founded in Argentina it is still MercadoLibre’s third-largest market today.

Inflation complicates business

There are multiple ways that Argentine inflation impacts an international company such as MercadoLibre which reports financial results in dollars. Consider the company’s lending business. Even if a loan is paid back on time at a good interest rate, each monthly payment in pesos is less valuable than the one before because the currency is rapidly devaluing relative to the dollar.

Furthermore, consider MercadoLibre’s local operations. It needs pesos to do business on a daily basis. But any profit it earns today doesn’t go as far tomorrow. To preserve spending power, it must convert to a stabler currency, such as dollars. But it needs pesos to do business on a daily basis.

Argentina’s central bank has printed money at a breakneck pace for years. According to the International Monetary Fund, from 2012 through 2022, the smallest annual increase to its money supply was 26%. And it’s been as high as 85% — nearly doubling in a single year.

Inflation is a headwind blowing hard against MercadoLibre’s Argentine business. It has been bad largely due to out-of-control money printing. However, after decades of problems, the winds may finally be turning.

A new economic direction for Argentina?

In November 2023, political outsider Javier Milei won Argentina’s presidential election, promising economic reform. In response, a group of more than 100 economists wrote an open letter of warning. They wrote that Milei’s economic proposals, “are likely to cause more devastation in the real world in the short run.”

There’s starting to be reason to question the economists. Argentina’s government just achieved its first surplus in 16 years, and the monthly inflation rate fell below double-digit percentages for the first time in six months. Granted, Milei’s administration laid off government workers, and the economy will likely drop further into a recession. But the changes are already going better than anticipated.

The International Monetary Fund is evidently optimistic about what it sees in Argentina, considering it just unlocked an $800 million disbursement to the country after reviewing its economy.

At a later date, Argentina could even adopt the U.S. dollar as its official currency, which would eliminate the ongoing devaluation of the peso relative to the dollar. This would also help to keep MercadoLibre from losing money on fluctuating currency exchange rates as it regularly does.

What to do now if you are considering MercadoLibre

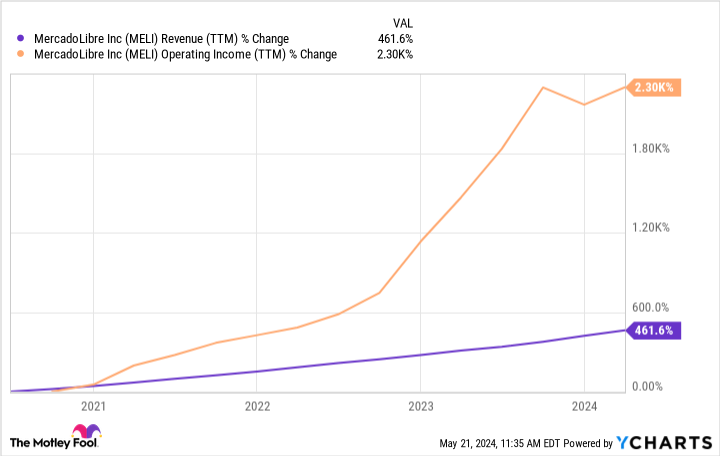

Even with the enormous inflationary headwinds blowing against it — not only in Argentina but elsewhere as well — MercadoLibre continues to post incredible growth. Its logistics network is driving e-commerce adoption, and its digital financial services are in high demand. Moreover, the company’s operating income is soaring as its revenue grows.

It’s still really early in Milei’s presidency. Therefore, it’s entirely possible that the current bright spots with the economy will be short-lived and the aforementioned economists will be proved correct.

However, even if that’s the case, the Argentina market has dropped down to about 14% of MercadoLibre’s total revenue as of the first quarter of 2024. That’s consequential, but it wouldn’t doom the business if the Argentine economy drastically dropped. The company would still have strong results in Brazil, Mexico, and elsewhere to fall back on.

That said, it’s worth mentioning that important people are already buying into Argentina’s turnaround. Among them is billionaire Stanley Druckenmiller, who has started investing in Argentine companies thanks to Milei’s economic policies. Therefore, investors who are optimistic about Argentina’s long-term economic outlook are in good company.

MercadoLibre doesn’t necessarily need Argentina’s economy to boom to be successful — it’s proven for years that it can push through the headwind. However, if this turns into a tailwind in the coming years, it could be quite a good thing for its business and the company’s shareholders.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre. The Motley Fool has a disclosure policy.

Is 1 of MercadoLibre’s Strongest Headwinds Finally Turning Into a Tailwind for the Stock? was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.