(Bloomberg) — JD.com Inc. posted a stronger-than-expected 1.7% rise in quarterly revenue, after heavy promotional spending propelled online transactions in the face of intense competition.

Most Read from Bloomberg

Revenue came to 247.7 billion yuan ($34.2 billion) in the September quarter, versus the 246.6 billion yuan average analyst estimate. Net income rose 33% to 7.9 billion yuan. Its shares rose 4.5% in pre-market trading in New York.

The Beijing-based company has embarked on a price war to wrest market share away from rivals such as Alibaba Group Holding Ltd. and PDD Holdings Inc., at a time consumers are cutting back in a downturn. It’s trying to reclaim ground lost both to its traditional rivals and newer entrants like ByteDance Ltd.’s Douyin. JD’s now pivoting toward offering consumers wider price ranges and product categories, diversifying from its traditional focus on bigger-ticket items such as smartphones, targeting more frugal post-pandemic shoppers.

It’s unclear if that’s having the desired effect. JD and its larger rival Alibaba likely logged mere single-digit percentage growth during the just-concluded annual Singles’ Day shopping festival, falling well short of ByteDance and other fledgling operators such as Kuaishou Technology.

What Bloomberg Intelligence Says:

The e-commerce firm probably incurred higher operating costs, led by persistent hikes in fee subsidies for merchants and advertising spending, which already helped double the number of third-party sellers on JD.com in 2Q vs. a year earlier. The company’s goal of keeping product prices on its platform affordable through 2023, as part of its 10 billion yuan subsidy program, raises the likelihood that such cost increases will persist through 4Q.

– Catherine Lim and Trini Tan, analysts

Click here for the research.

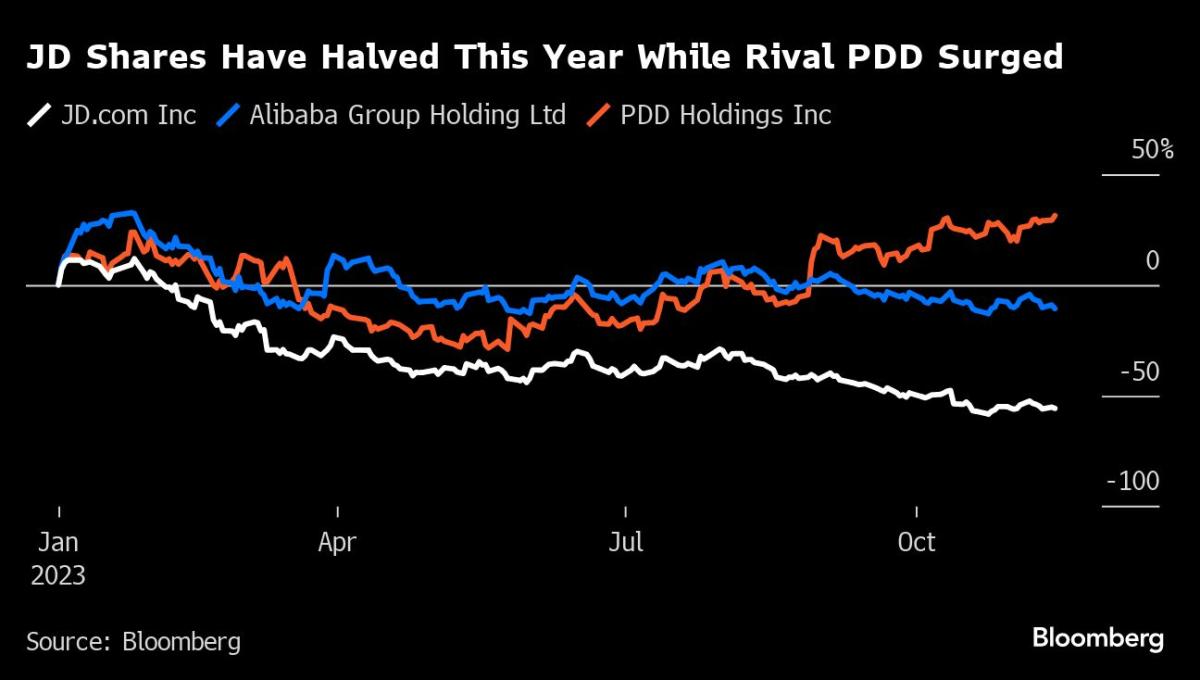

Chinese consumption has flagged, dogged by a crumbling property market and rising youth unemployment. Deflationary pressures worsened in October, spurring concerns about the country’s growth trajectory. JD.com’s stock price has dropped more than 50% this year.

JD’s performance remains a far cry from the double-digit percentage expansions of previous years, before Beijing’s clampdown on internet spheres from online commerce to ride-hailing chilled the sector. Though JD.com avoided the worst of that years-long crackdown, it’s struggling to regain momentum after years of punishing Covid Zero restrictions gutted the world’s No. 2 economy.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.