-

Nvidia stock doesn’t look expensive even at a $2 trillion valuation, according to Bank of America.

-

The bank increased its Nvidia price target to $1,100 ahead of its “AI Woodstock” event, implying 24% upside.

-

BofA said Nvidia is trading at a lower forward P/E ratio than it was in November 2022.

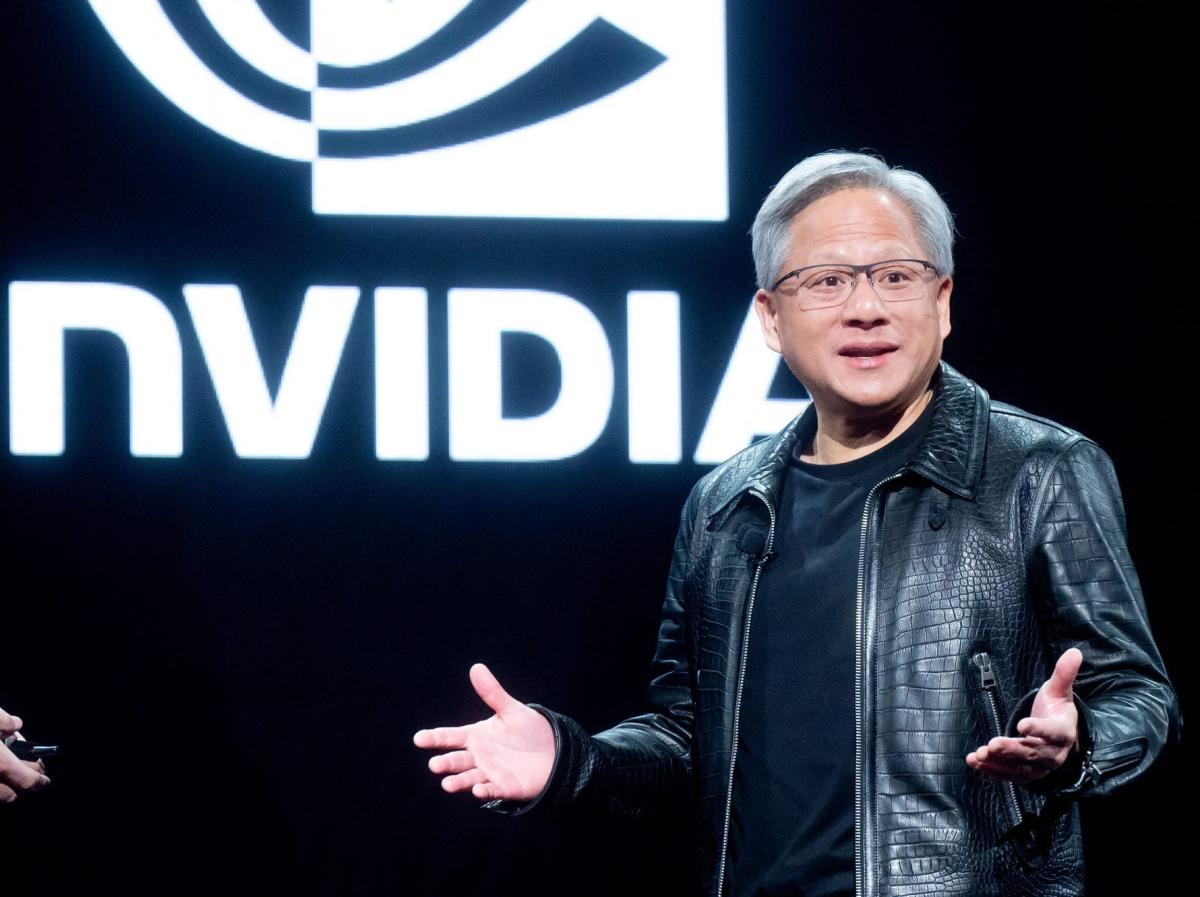

Even at a $2.2 trillion valuation, Nvidia stock still isn’t expensive, Bank of America said in a note on Wednesday.

The bank reiterated its “Buy” rating and increased its price target to $1,100 from $925, representing potential upside of 24% from current levels.

“Despite YTD outperformance, NVDA valuation and ownership attractive compared to semis/infotech peers,” Bank of America analyst Vivek Arya said.

Shares of Nvidia have surged 80% year-to-date and are up 287% over the past year as demand for its AI-enabling graphic cards remains insatiable.

But amid the stunning success of Nvidia’s underlying business, the company’s stock is still trading at valuations lower than when ChatGPT was first launched in 2022.

“NVDA trading lower today at 37x NTM PE vs. 44x PE when ChatGPT was launched in November 2022,” Arya said, adding that the stock is trading well within its historical forward price-to-earnings range of 26x to 69x.

Meanwhile, while most investors own Nvidia stock, they’re still underweight the stock relative to its weight in the S&P 500.

“Valuation, ownership levels still suggest room for upside,” Arya said. “Our recent ownership analysis suggests that while NVDA is broadly owned (67% of funds in our survey), relative weighting (NVDA ownership concentration vs. concentration in SPX) is below large cap infotech peers (1.01x vs. 1.13x peers) despite nearly 9x faster growth potential,” Arya said.

Further upside in Nvidia stock could be sparked by its “AI Woodstock” event on March 18, when it hosts its GPU Tech Conference and is set to unveil the successor to its wildly popular H100 chip.

“We expect GTC to showcase: 1) Rising impact of genAI, omniverse/digital twins across a wide range of end-markets, 2) Opportunity to re-architect nearly $1-$2Tn of global computing infrastructure with accelerators, resulting in a $250-$500bn annual market (vs $250bn prior) over the next 3-5 years, 3) Pipeline update across accelerators (B100, N100), Ethernet switches, DPU, and edge AI,” Arya said.

Read the original article on Business Insider

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.