-

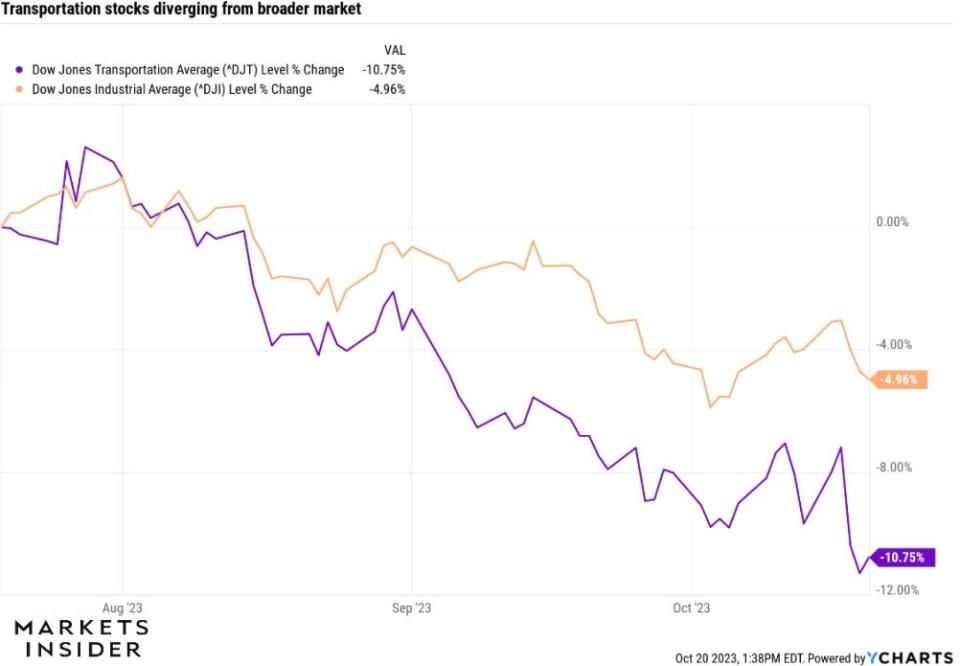

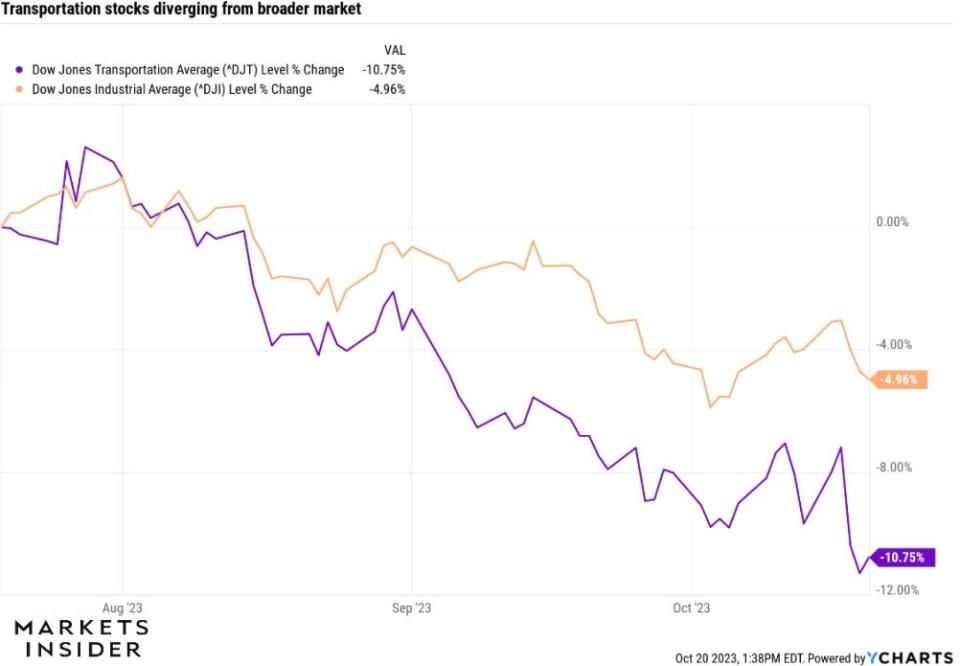

A decline in transportation stocks is sending a worrying signal about the broader stock market.

-

Transportation stocks are viewed as a leading indicator because they point to the movement of goods around the country.

-

Recent earnings reports from airline and trucking companies missed analyst expectations considerably.

A steady decline in transportation stocks is sending a worrying signal about the broader stock market and its chances to stage a year-end rally.

The Dow Jones Transportation Index fell below its early-October support level this week and hit its lowest level since mid-June on Friday. The index is down 14% since its late July high.

The decline is worrying because transportation stocks are viewed as a leading indicator for both the stock market and economy, as these companies are tasked with moving goods and people across the country, which is vital to ongoing economic growth. If companies are seeing a slowdown in growth and their stock prices fall, it could be a grim warning for the rest of the economy and stock market.

The ongoing decline in transport stocks was exacerbated this week following underwhelming earnings results from airline and trucking companies.

J.B. Hunt said its third-quarter revenue fell 17.6% amid lower freight rates, United Airlines offered fourth-quarter guidance that was weaker-than-expected due to rising fuel costs and disruptions to its flight routes to Israel, and American Airlines said it was cutting its 2023 profit forecast.

Meanwhile, CSX Transportation, the fourth largest railroad company by market value, said its volumes fell 2% in the third-quarter.

The Dow Jones Transportation’s decline below its early-October low is in contrast to the Dow Jones Industrial Index, which is still holding above its early-October low of about 33,000. Over the past three months, losses in transport stocks have been more than double the losses seen in the broader market.

This represents a short-term divergence between two groups of stocks that typically move in tandem during bullish market regimes. For the two indexes to converge, as they typically do, either the transports would have to stage a strong rebound, or the broader market would have to fall a few more percentage points from current levels.

And if the latter happens, crucial support levels would be broken and investors’ highly anticipated year-end rally in the stock market, partly explained by bullish seasonals, would be on thin ice.

But there is reason for optimism, as some of the woes seen in the recent earnings results of transport companies could be temporary.

“We are not at a point yet to say we’re out of the freight recession, but we do feel like we’re coming out of it or said differently, directionally we are seeing signs of things moving in a positive direction,” J.B. Hunt President Shelley Simpson said on Tuesday.

Meanwhile, American Airlines CEO Robert Isom told CNBC on Thursday that he expects strong holiday bookings this December.

“It’s a rocky time, but that said, I see demand, especially as we approach the holidays, very strong. We’re booked strong than we were at the same time last year… overall I feel really good about where demand is… as I take a look out into 2024, I see robust demand,” Isom said.

Finally, CSX CEO Joe Hinrichs said he’s seeing steady economic progress despite this quarter’s volume slump.

“Our merchandise business remains steady, and our coal shipments were very strong. Our domestic intermodal volumes are growing well compared to last year, while our international intermodal business, though down year-over-year, has stabilized,” Hinrich said on his company’s third-quarter earnings call.

Despite the recent weakness in transportation stocks, the Dow Theory buy signal that flashed earlier this year remains valid, suggesting that the primary trend in the markets is still up and the recent decline is, for now, a typical correction.

“I remain bullish if the Dow Industrials does not break down on a closing basis below its October 3 closing lows at 33,002.38,” Manuel Blay, editor of TheDowTheory.com, told Insider on Friday. “I consider the bullish trend intact if the Dow Industrials holds above its October 3 closing lows.”

Dow Industrials fell about 200 points to 33,239 on Friday, just 0.72% higher than the index’s October 3 closing low.

Read the original article on Business Insider

Daniel Miller is a sports fanatic who lives and breathes athletics. His coverage spans from major league championships to local sports events, delivering up-to-the-minute updates and in-depth analysis for sports enthusiasts.