After decades of success, legendary money manager Stanley Druckenmiller “retired” to manage the Duquesne Family Office. The firm’s portfolio currently has approximately $3.3 billion in assets under management.

Of that total, a whopping 21% is in two artificial intelligence (AI) stocks, Microsoft (NASDAQ: MSFT) and Nvidia (NASDAQ: NVDA). These two AI stalwarts have clobbered the broader stock market over the years.

But does that make them suitable for your portfolio today? Here is what you need to know.

1. OpenAI is a long-term boost for Microsoft’s cloud business

Tech giant Microsoft has been part of the Duquesne Family portfolio for a decade. Druckenmiller bought his first shares back in 2014. The company had already been a multi-decade winner, and the rise of AI has only added more juice to Microsoft’s growth, catapulting the company to an eye-popping $3 trillion market capitalization. Microsoft built an empire on personal computer software but has expanded to enterprise software, gaming, and cloud computing.

Microsoft’s genius move was to see the beginning of AI begin to take shape and partnering with software developer OpenAI back in 2016. The company furthered that partnership in 2019 and again in early 2023, as OpenAI’s generative AI model ChatGPT launched and changed the entire technology industry.

Today, Microsoft and OpenAI are deeply intertwined, including cloud exclusivity for Azure on all OpenAI compute workloads. That exposure is helping grow Azure as it works to close the market share gap with the current leading platform, Amazon Web Services (AWS). Recent data suggests Azure has an estimated 24% of global cloud business as of the fourth quarter of 2023, an all-time high for the company.

These developing trends, along with Microsoft’s position as an all-around tech juggernaut, make the stock an easy buy-and-hold for any investor.

2. Nvidia’s head start in AI chips is a potential moat

Druckenmiller had dabbled in Nvidia a couple of times but leaned into the company in late 2022, just as the first ripples of AI were beginning. The Duquesne Family fund bought 583,000 shares in late 2022 and added along the way in what has been a home run. The stock has appreciated over 400% since the start of 2023. In recent quarters, Druckenmiller has taken some profits, but Nvidia remains the fund’s third-largest holding.

Nvidia has become the runaway leader in AI chips. How? Nvidia realized that AI computing would potentially work better on GPU chips, like what it specializes in, versus traditional processor chips. Nvidia began focusing on data centers in the late 2010s, and the explosion of AI has launched Nvidia into a leadership position rather quickly. Analysts estimate that as much as 90% of the AI chip market belongs to Nvidia, and that market could grow to hundreds of billions of dollars over the next several years.

Thanks to AI, the data center business has become the majority of revenue for a company that was once known for gaming chips. It’s a monumental shift that has lucratively rewarded shareholders. Competition will push back on Nvidia’s dominance, including some big customers working to build alternatives. Nonetheless, Nvidia plays a massive role in creating the computing foundation needed to utilize AI throughout the modern economy. It’s hard to see that dramatically changing.

How investors should approach each stock

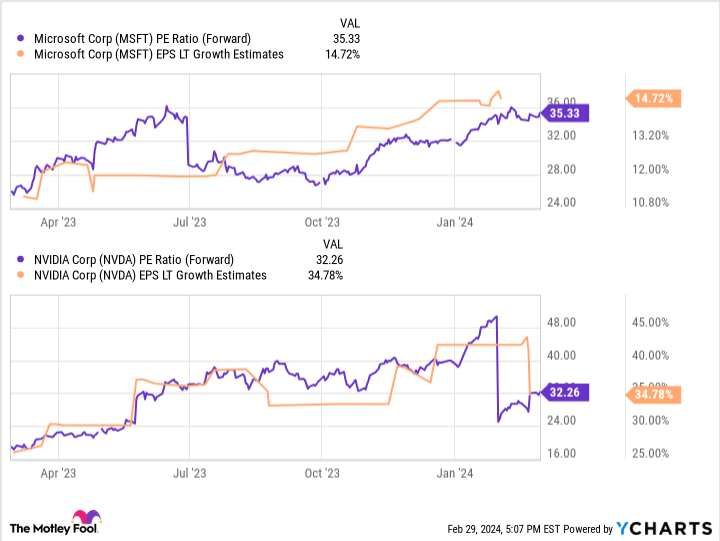

It’s hard to call stocks cheap when they’ve appreciated as much as Microsoft and Nvidia have, but these stocks aren’t as eye-poppingly expensive as you would think. If you look at each stock’s price/earnings-to-growth (PEG) ratio to compare their earnings multiple to their expected growth rate, Microsoft is a little steep at a PEG ratio of 2, but there are far worse deals on Wall Street. At a PEG of 1, Nvidia is arguably a bargain if it can meet the long-term expectations analysts have set forth.

Investors should remember that Druckenmiller is already sitting on massive gains, so it’s not necessarily suitable to run out and buy these companies because some billionaire owns them. But if you believe that Microsoft or Nvidia can continue delivering over the coming years, buying a little at a time to build an investment slowly would be an excellent way to add these stocks to your portfolio.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Billionaire Investor Has 21% of His Portfolio Invested in These 2 Artificial Intelligence Growth Stocks was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.