As the anniversary of “Black Monday” approaches, some on Wall Street are observing it by swapping ominous-looking charts and speculating that one of the most terrifying days in markets history might recur.

One could even go as far to say that on social media, some seem eager to relive it, evidenced by a proliferation of viral markets charts, some comparing the stock market’s recent trading action to 1987. Here’s one example from The Market Ear which adheres to a template that caught on following the publication of a column by Bloomberg’s John Authers.

THE MARKET EAR

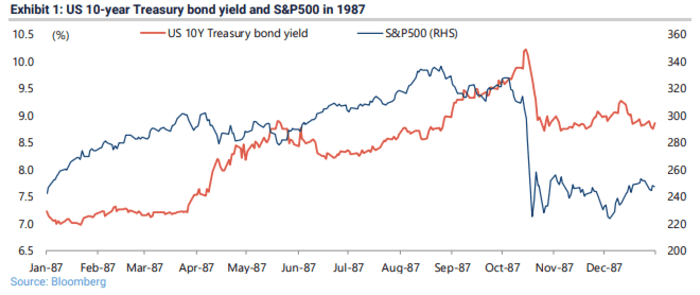

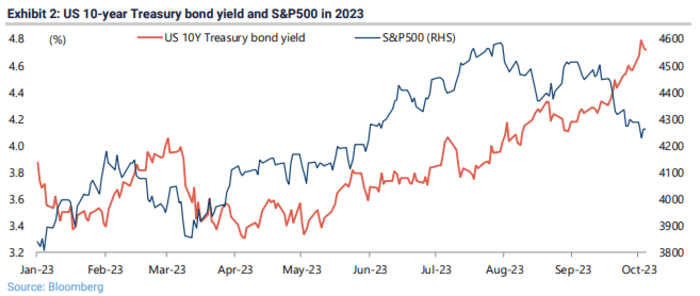

Authers pointed out that the Nasdaq in 2023 has followed a similar pattern to the Dow in 1987, and that this pattern has also played out in Treasury yields.

To be sure, there are plenty of differences between markets today and in 1987. For one, stock exchanges have strengthened circuit-breaker mechanisms in order to prevent major indexes from crashing by double digits during a single session.

Here is another: While the S&P 500

SPX

has climbed this year in spite of rising yields, the index’s gains have been concentrated in a handful of stocks. Outside of these lucky few, much of the market has lagged or has continued to slide following losses in 2022.

Skeptics contend fretful investors are hearing echoes of 1987, while ignoring important differences.

“In 1987, the market was more overbought, the October decline before the crash was far more pronounced, interest rates were higher, economic growth and inflation were accelerating, and cyclical sectors were stronger” — all in contrast with the current setup, noted Ed Clissold and Thanh Nguyen, strategists at Ned Davis Research, in a note last week.

That hasn’t daunted doomsayers on social media, eager to augur a crash ahead of this year’s anniversary, which falls on Thursday.

On Oct. 19, 1987, the Dow Jones Industrial Average

DJIA

plunged 508 points, a decline of almost 23%, in a daylong selling frenzy that ricocheted around the world and tested the limits of the financial system. The S&P 500 dropped more than 20%. At current levels, an equivalent percentage drop would translate into a one-day loss of over 7,700 points. Circuit breakers make a drop of similar magnitude nearly impossible.

Even on Wall Street, some are using the anniversary as an opportunity to take another look at Treasury yields and the dark cloud they’re casting over stocks.

Jefferies’ Global Head of Equity Strategy Christopher Wood recently shared a couple of charts comparing the relationship between stocks and bond yields in 2023 to 1987, driving home the point that stocks appeared resilient to higher yields in 1987 until they finally capitulated with an economy-shaking selloff.

JEFFERIES

JEFFERIES

“The potential similarity with what occurred in October 1987 is that the historic stock market crash was preceded by a big sell-off in the 10-year Treasury over the summer months,” Woods said in the report.

But suppose, for argument’s sake, that stocks did experience a 1987-style selloff. How then might the bond market react? Would yields tumble like they did in 1987, opening the door for stocks to bolt higher once again? Some on Wall Street have posited that a stock-market rout is necessary to stem the bleeding in bonds.

Woods delved into this line of thinking in his report.

“But the other salient point to note is that when the S&P 500 subsequently collapsed by 28.5% in four days, and by 20.5% on 19 October 1987 alone, the Treasury bond market staged a classic flight-to-safety rally in the context of a then dramatic decline in the 10-year Treasury bond yield,” Woods added.

Société Générale’s sharp-tongued strategist Albert Edwards has also warned about the possibility of a 1987-style crash.

See: ‘Just like in 1987.’ Here’s what could deliver a ‘devastating blow’ to stocks, says SocGen strategist Albert Edwards.

But NDR’s Clissold and Nguyen argued that “while there are several high-level similarities, not enough line up to conclude that a crash-like event is likely.

Sarah Wilson is your guide to the latest trends, viral sensations, and internet phenomena. With a finger on the pulse of digital culture, she explores what’s trending across social media and pop culture, keeping readers in the know about the latest online sensations.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24997607/236833_Asus_Chromebook_Plus_CX34_AKrales_0047.jpg)