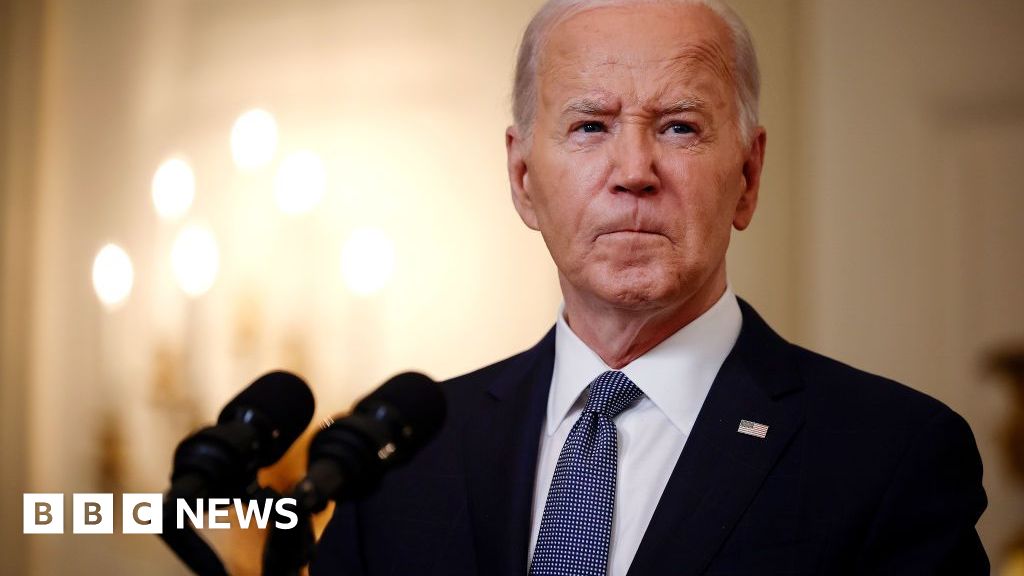

U.S. President Joe Biden announced a new 100% tariff on Chinese-made electric vehicles (EVs) on May 14 as part of a wider set of measures to protect U.S. producers from cheap and subsidized imports. The measure is designed to protect the likes of Tesla (NASDAQ:TSLA) and General Motors (NYSE:GM) from companies like BYD (NASDAQ:BYDDF), Li Auto (NASDAQ:LI), and NIO (NASDAQ:NIO). However, I don’t expect the tariffs to have any material impact on these companies. Therefore, I remain bullish on Li Auto and neutral on NIO.

The announcement sees the tariff on Chinese EVs imported into the U.S. quadruple from 25% to 100%. However, the act seems largely symbolic, with most Chinese automakers focusing their efforts on the sizeable indigenous market and, to a lesser extent, Europe and the Middle East.

What Do Tariffs Mean for Li Auto and NIO?

The Biden administration claims that the new measures are a response to Chinese overproduction. It says the country is producing as many as 30 million EVs annually while indigenous market demand is much weaker — around 22-23 million. So, what does this higher tariff mean for Li Auto and NIO? Well, very little. Currently, neither Li nor NIO has a major presence in the U.S. market. Thus, the immediate impact on sales might be minimal.

NIO had previously said it was looking at entering the North American market in 2025 but later backtracked on plans, saying it was “debating” whether to do so. While its plans were fluid, NIO was one of the only Chinese EV makers to publicly consider entering the U.S. market. However, success in the U.S. market has arguably never been part of the investment hypothesis.

According to the Chinese media outlet LatePost, Li Auto plans to enter the overseas market this year, initially focusing on the Middle East, including the UAE, Saudi Arabia, and some North African countries. The report, citing several people familiar with the matter, said the first model available overseas would be the flagship L9. There was no mention of the U.S. market.

Interestingly, Li Auto’s decision to push toward the Middle East appears to be influenced by some observational data. Li Auto’s management said staff had noted that 200 of its vehicles sold in July 2023 weren’t insured in China. On closer inspection, the company realized that traders were buying the vehicles and shipping them overseas — mostly to the Middle East and Central Asia. CEO Li Xiang posted a picture of an L7 for sale in Kazakhstan priced $25,800 higher than its starting price in China.

As such, the Biden administration’s new tariff regimen seems little more than symbolic, and potentially political, as U.S. presidential challenger Donald Trump had threatened to take similar measures should he return to power. Being “hard on China” remains popular with voters.

Should I Invest in Li Auto or NIO?

I hold Li Auto shares and remain bullish on the company despite a downturn in production and delivery performance this year. The company, which had previously focused on the EREV (extended range electric vehicle) market before recently releasing its first BEV (battery electric vehicle), currently trades at 16.1x forward earnings. That’s remarkably cheap compared to Tesla, which is more than four times more expensive.

Li Auto is expected to deliver earnings per share growth of 13.5% annually over the medium term — the next three to five years. In turn, this leads us to a price-to-earnings-to-growth (PEG) ratio of 1.06x. This figure used to be much lower, but growth forecasts appear to have been dialed down after a disappointing start to 2023.

Meanwhile, I’m unconvinced by NIO. The stock has recently staged a recovery but is priced at a fraction of its pandemic-era highs. NIO isn’t expected to turn a profit until 2027, and it’s currently trading around 23.3x expected earnings for that year.

While some analysts remain bullish on NIO, I’m also unsure whether its battery-swapping technology really represents the way forward. Its battery-swapping station infrastructure will be a revenue-generating activity, but it requires a huge amount of CapEx to build. And with charging speeds increasing all the time, I do wonder whether battery-swapping will become obsolete.

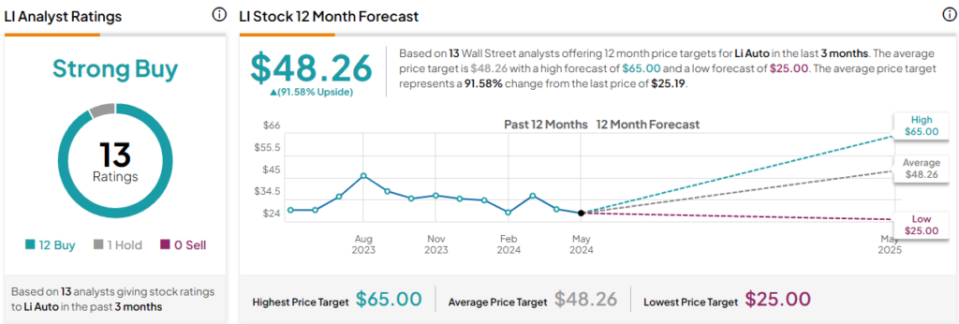

Is Li Auto Stock a Buy, According to Analysts?

Li Auto stock is rated a Strong Buy according to the ratings of 12 Wall Street analysts offering 12-month price targets. There are currently 12 Buys and one Hold rating. The average Li Auto stock price target is $48.26, with a high forecast of $65.00 and a low forecast of $25.00. The average price target represents 91.6% upside potential.

Is NIO Stock a Buy, According to Analysts?

NIO stock is rated a Moderate Buy on TipRanks. This is based on seven Buys, nine Holds, and one Sell rating. The average NIO stock price target is $6.63, with a high forecast of $10.40 and a low forecast of $4.00. The average price target represents 26.05% upside potential.

The Bottom Line on Li Auto and NIO Stock

The Biden administration’s quadrupling of tariffs on Chinese-made EVs doesn’t change my position on these two companies. As neither company operates in the U.S., the impact will be nominal. I remain bullish on Li Auto despite its inauspicious start to the year and neutral on NIO.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.