The Drug Enforcement Administration (DEA) is gearing up to reclassify marijuana in the US as a less dangerous drug, according to new reports, and cannabis company CEOs say the move has been a long time coming.

In what Curaleaf CEO Matt Darin called “a historic moment” for the industry, a DEA proposal reportedly seeks to reclassify marijuana from a Schedule III narcotic — a category that includes cocaine, fentanyl, and heroin — to a Schedule I narcotic, which includes ketamine, codeine, and steroids.

The proposal will still need to go through a lengthy process to become finalized and, crucially, will not legalize the substance in the US, but the federal reclassification of marijuana has been a long-term goal for the cannabis industry.

“Any step forward here, I think, certainly helps in the normalization of cannabis and demonstrates to legislators that there is widespread support for it,” Darin told Yahoo Finance. “While this is certainly a different process [than cannabis banking reform and other legislative actions], … I think it absolutely sends a signal to those in D.C. that there is widespread support for this, that the federal government acknowledges that there is a medicinal benefit to cannabis, and that, ultimately, this belongs regulated similar to other industries.”

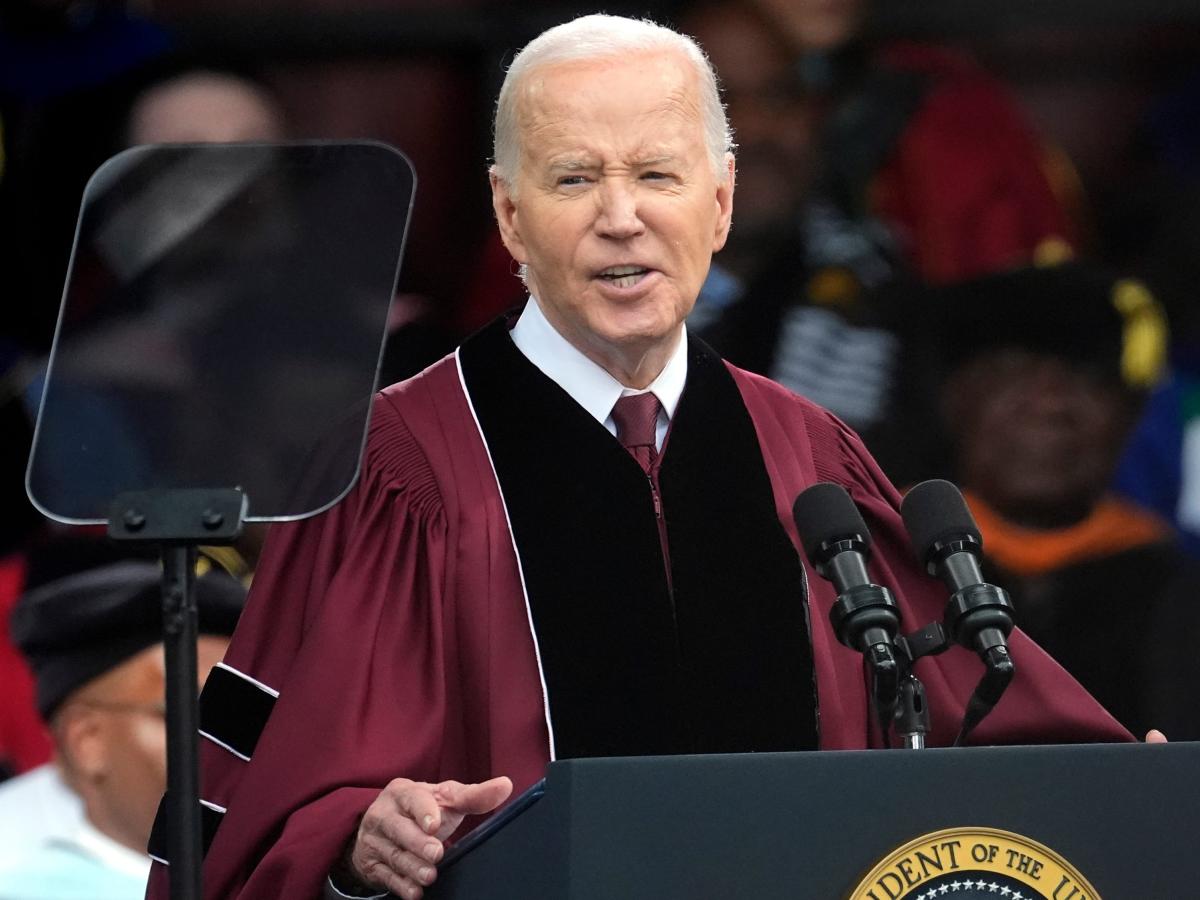

Trulieve CEO Kim Rivers highlighted that the DEA’s decision signifies progress on the issue after President Joe Biden and the Food and Drug Administration (FDA) requested a review of how cannabis is scheduled.

“The FDA findings were actually that marijuana is safer in many respects than alcohol, which is interesting in terms of having that on the record,” Rivers said. “It really is a critical first step as we think about additional regulatory and policy changes for the industry.”

Though cannabis stocks generally saw an increase in value following the news of a possible reclassification, they’ve continued to face volatility. The AdvisorShares Pure US Cannabis ETF (MSOS), which tracks shares of cannabis companies, jumped over 25% on April 30 after the news broke but pared those gains in the following week.

Shares of two of the largest cannabis companies, Curaleaf (CURLF) and Trulieve (TCNNF), had similar trajectories, reaching their highest values for the year before settling down. Trulieve reported a narrower first quarter loss in its earnings before the market open on Thursday, and Curaleaf will report earnings after the market close.

What reclassification means for the industry

A growing number of states support the legalization of marijuana. Currently, recreational cannabis use is legal in 24 states, while medical use is legal in 38 states.

If marijuana is reclassified as a Schedule III narcotic, there will immediately be more opportunities for businesses to invest in research and development.

For example, cannabis company CEOs expect their businesses would no longer be subject to Section 280E, a part of the IRS tax code that limits their ability to take deductions and raises their effective tax rate. Putting that money back into the business could make the industry more inviting to institutional investors and pharmaceutical companies, Curaleaf’s Darin explained, noting that Curaleaf could save over $150 million in excess tax contributions to the government.

“No other industry in America is subject to this type of punitive tax rate,” Darin said. “Freeing up that cash flow to reinvest in expansion, in personnel, in new business development I think is getting the attention of institutional investors and is going to continue to attract interest.”

Trulieve’s Rivers said reclassification could help normalize the marijuana industry’s banking practices, helping it gain access to loans and move away from operating as a cash-only business. That could help small and minority-owned businesses continue to grow.

“As many who follow the industry know, we have been stalled in Congress in getting passed the SAFER banking bill,” Rivers said, referring to a bill currently held up in the Senate that would open up access to deposits, insurance, and other financial services for the industry.

“That would level the playing field as it relates to banking,” Rivers continued, “and, importantly, would allow for us to take credit cards so we wouldn’t have to have as much cash on-hand, which makes us a target, of course, for crime, as there have been some horrific reports of robberies that have happened at dispensaries across the country.”

Darin also suggested that there could be increased mergers and acquisitions activity in the marijuana industry in general; though when asked about rumors of a potential merger between Curaleaf and Trulieve, he didn’t speak to that specific idea.

“We’ll continue to be opportunistic as we look at expansion opportunities, and I do think rescheduling will open up the markets,” Darin said.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.