Shares of Broadcom (NASDAQ: AVGO) were up 6.1% as of 3 p.m. ET Thursday following a bullish analyst note from Goldman Sachs on the semiconductor products company.

Why Goldman Sachs expects Broadcom to outperform

In a note to clients this morning, Goldman analyst Toshiya Hari reinstated coverage on Broadcom with a buy rating and a 12-month price target of $1,325 — a 16% premium from yesterday’s close.

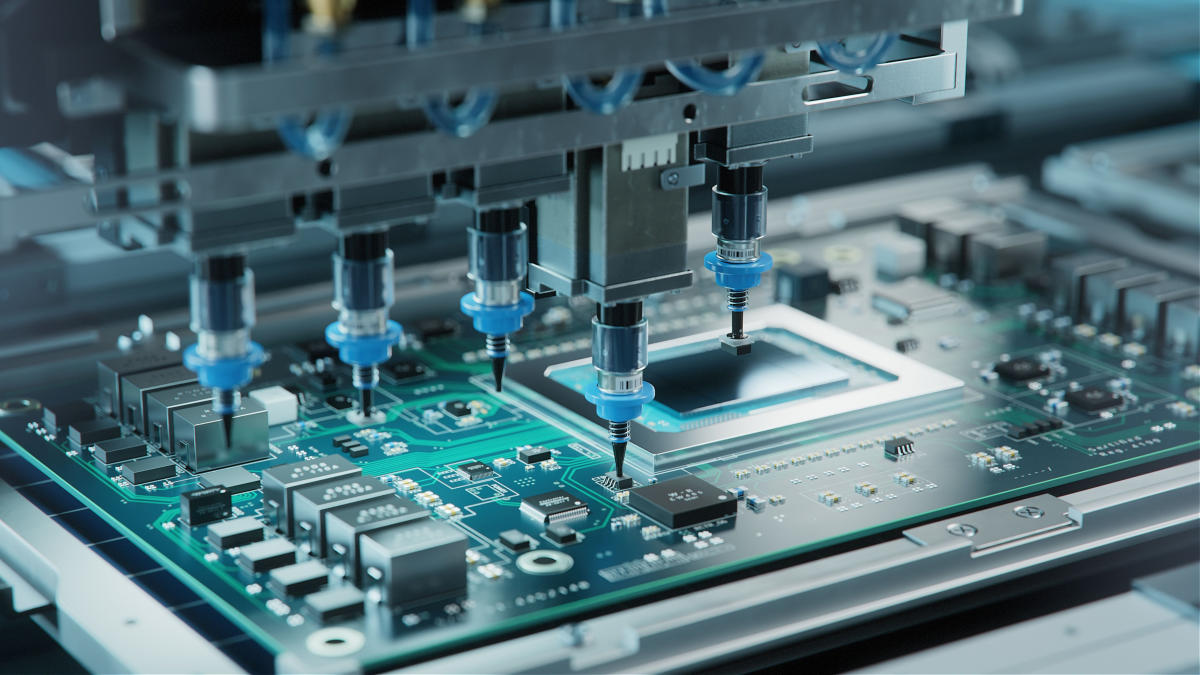

To justify his bullishness, Hari pointed to double-digit percent growth in Broadcom’s products related to generative artificial intelligence (AI), including high-speed networking and custom compute solutions. Hari also argued that Broadcom is poised to benefit from a cyclical recovery in its core semiconductor segment as enterprise spending rises in the coming quarters. Finally, he suggested that Broadcom has yet to realize significant operating leverage and synergies following its acquisition of VMware, which closed in November 2023.

What’s next for Broadcom investors?

Assuming the timing of Broadcom’s past releases are any indication, investors can expect Broadcom to announce its fiscal first-quarter 2024 results in early March. Broadcom hasn’t provided specific quarterly guidance, but its full fiscal-year 2024 outlook calls for revenue of roughly $50 billion — up roughly 39.5% year over year including contributions from acquisitions — with adjusted EBITDA margin of roughly 60% of revenue.

Whether Broadcom adjusts that outlook based on recent business trends remains to be seen. But given this strong vote of confidence from Wall Street in the meantime, it’s no surprise to see shares rallying now.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Steve Symington has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Why Broadcom Stock Jumped Today was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.