Snowflake (NYSE: SNOW) stock is losing ground in Thursday’s trading. The company’s share price was down 5.8% as of 3 p.m. ET, according to data from S&P Global Market Intelligence.

After the market closed on Wednesday, Snowflake published the results for the first quarter of its 2025 fiscal year, which ended April 30. While the company’s sales came in ahead of the market’s expectations, earnings for the period were lower than Wall Street had anticipated.

Snowflake’s sales beat is overshadowed by earnings miss

Snowflake posted non-GAAP (generally accepted accounting principles) adjusted earnings per share of $0.14 on revenue of $828.71 million in fiscal Q1. Meanwhile, the average analyst estimate had called for the business to post adjusted per-share earnings of $0.17 on revenue of roughly $828.75 million.

The data-warehousing specialist’s product revenue increased 34% to hit $789.6 million. Overall revenue for the period was up 32.9% compared to the prior-year period. The company closed out the period with 485 customers with trailing-12-month product revenue greater than $1 million — up from the 461 customers that it had in the cohort in Q4 last year. Snowflake’s net revenue retention rate also slipped to 128% — down from 131% in the fourth quarter of fiscal 2024 and 151% in the first quarter of that year.

When will AI-driven demand accelerate?

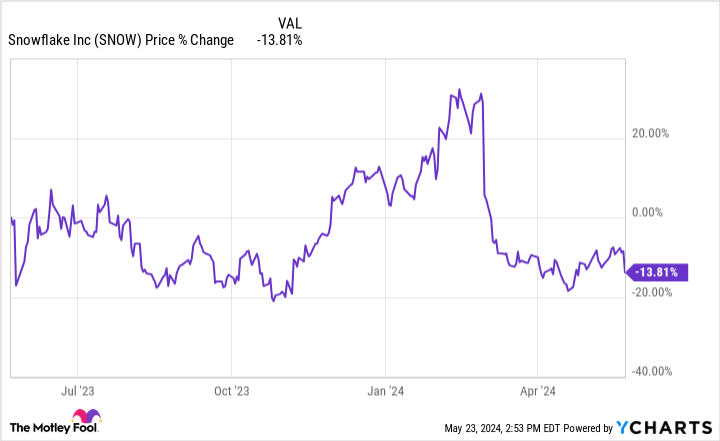

As a leading provider of services that help organizations combine, sort, and analyze data, Snowflake looks poised to see some demand tailwinds related to the rise of artificial intelligence (AI). On the other hand, the company’s share price is now down roughly 14% over the last year.

For the second quarter of its current fiscal year, Snowflake expects product revenue to come in between $805 million and $810 million. At the midpoint of that guidance range, that would mean delivering year-over-year growth of approximately 26.5%. The company expects to post an operating income margin of roughly 3%. While the company’s forward guidance isn’t bad by any stretch of the imagination, it looks like investors were looking for the business to see a bigger performance boost from AI.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $581,764!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.

Why Snowflake Stock Is Falling Today was originally published by The Motley Fool

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.