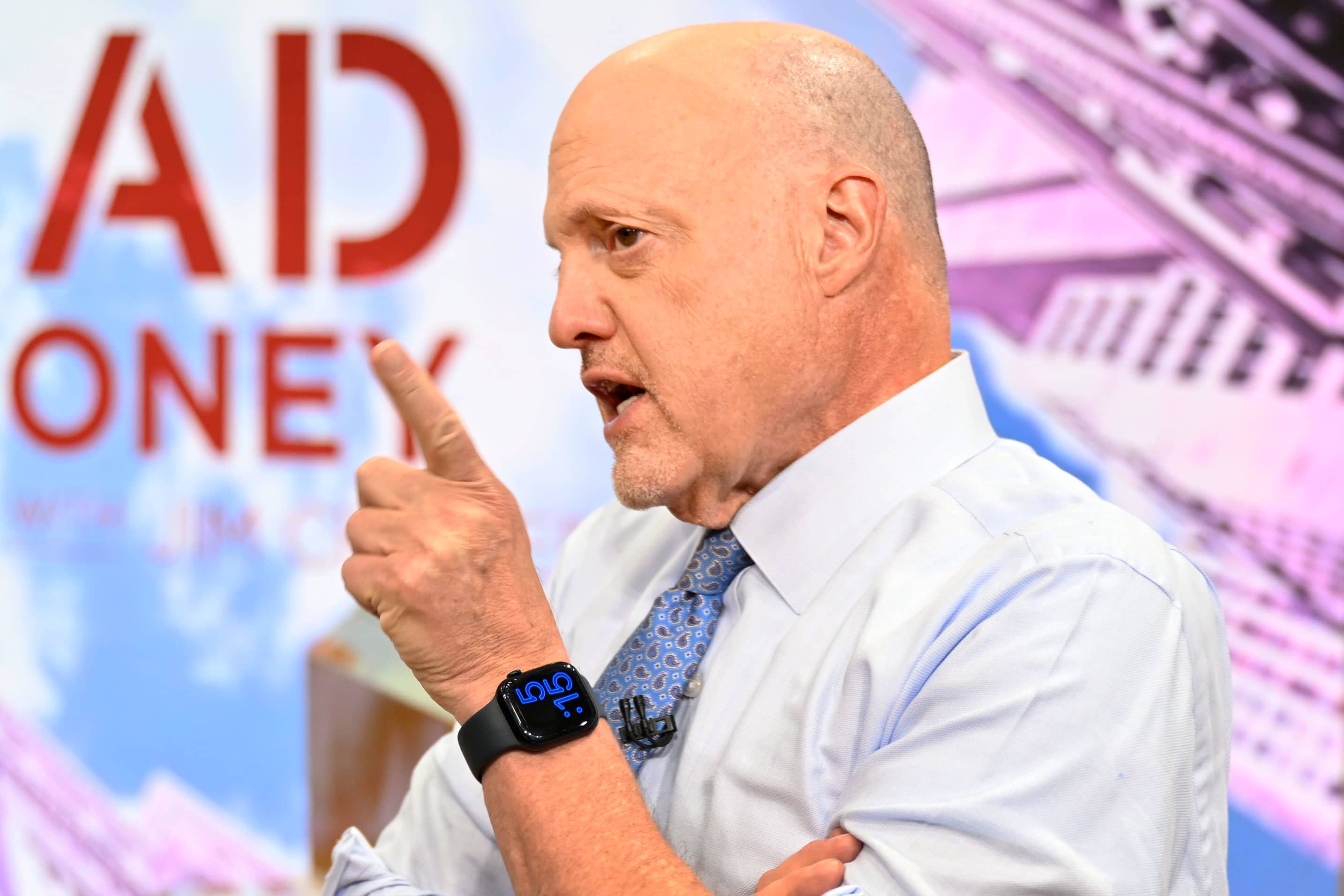

- CNBC’s Jim Cramer gave his take on Wednesday’s rally, cautioning investors against buying just any stock.

- “Today’s session shows people are itching to get into this market in the worst way, and sometimes the worst way is to just knock on wood and buy anything that’s fallen behind,” he said.

CNBC’s Jim Cramer examined Wednesday’s market action, saying the continued rally has eager buyers searching for promising stocks.

The major indexes saw gains Wednesday, thanks to more promising inflation data that could signal an end to the Federal Reserve’s tightening cycle. Cramer said many on Wall Street may find new reasons to own different stocks that lagged behind in the past, but he cautioned against buying just anything.

“Today’s session shows people are itching to get into this market in the worst way, and sometimes the worst way is to just knock on wood and buy anything that’s fallen behind,” he said.

Cramer first pointed to Target as an example. The big box retailer finished Wednesday up nearly 18%, with a rally fueled by an earnings report that easily topped Wall Street’s expectations. Cramer said investors rushed to buy Target’s stock because they were “looking for laggards that perhaps shouldn’t be laggards,” or stocks that can play catch-up. He added that the company may look more attractive to Wall Street if inflation cools and consumers have more money to spend.

Estee Lauder also fits this pattern, Cramer said. The cosmetics company had a major collapse from its highs earlier in the year, but has seen gains over the last few days. Estee Lauder does a significant amount of business in China, and Cramer suggested the stock’s rally could be fueled by hopes surrounding President Joe Biden’s meeting with Chinese President Xi Jinping.

“I think it’s worth breaking down today’s move because it shows how much people want to own stocks here, buy stocks here,” Cramer said. “They’ve just had trouble finding new ideas that fit a scenario where inflation’s rapidly cooling and we’re coming to the end of the Fed’s rate hike cycle.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Estee Lauder.

Jessica Roberts is a seasoned business writer who deciphers the intricacies of the corporate world. With a focus on finance and entrepreneurship, she provides readers with valuable insights into market trends, startup innovations, and economic developments.